For many people from all around the world, the UK is a popular place to find work and start a job. Indeed, the country has a diverse economy, from manufacturing and engineering to hospitality and finance. Many international jobseekers head to big cities such as London and Manchester, which have sizeable foreign workforces. However, you’ll find opportunities right across the kingdom.

Understand employment law in the UK and know your rights by reading the following sections:

- Employment law in the UK

- Foreign workers – your right to work in the UK

- Employment contracts in the UK

- Wages and salary in the UK

- Work hours in the UK

- Paid and unpaid leave in the UK

- Parental rights in the UK

- Social security and tax in the UK

- Protection from discrimination at work in the UK

- Joining a union in the UK

- Terminating the employment relationship in the UK

- Company mergers and insolvencies in the UK

- Temporary, part-time, agency, and informal workers in the UK

- Making a complaint as a worker in the UK

- Useful resources

Employment law in the UK

The UK has a sophisticated set of employment laws that have developed over the years to help protect workers. Regulations are in place governing key areas such as pay, holiday entitlements, and dismissal.

However, there is much inequality in practice when it comes to the realization of worker rights. Although employees in higher-status jobs generally enjoy good protection and conditions, employment law in the UK is often poorly enforced in certain sectors. The country ranks 39th on the 2021 Global Rights Index (which measures trade union and workers’ rights) with a score that denotes “regular violations of rights”.

Employment law in the UK goes back to the late 19th century. Trade unions were legalized in 1871 and social security measures such as pensions slowly developed in the first half of the 20th century. However, labor legislation concerning most areas discussed in this guide is a more recent thing. The Contracts of Employment Act 1963 was the first key act, introducing written contracts and notice periods.

Important modern pieces of labor legislation in the UK include:

- Employment Rights Act 1996 – an update on previous acts covering rights in dismissal, parental leave and redundancy.

- National Minimum Wage Act 1998 – introduced a minimum wage in the UK.

- Equality Act 2010 – strengthened laws on discrimination in the workplace.

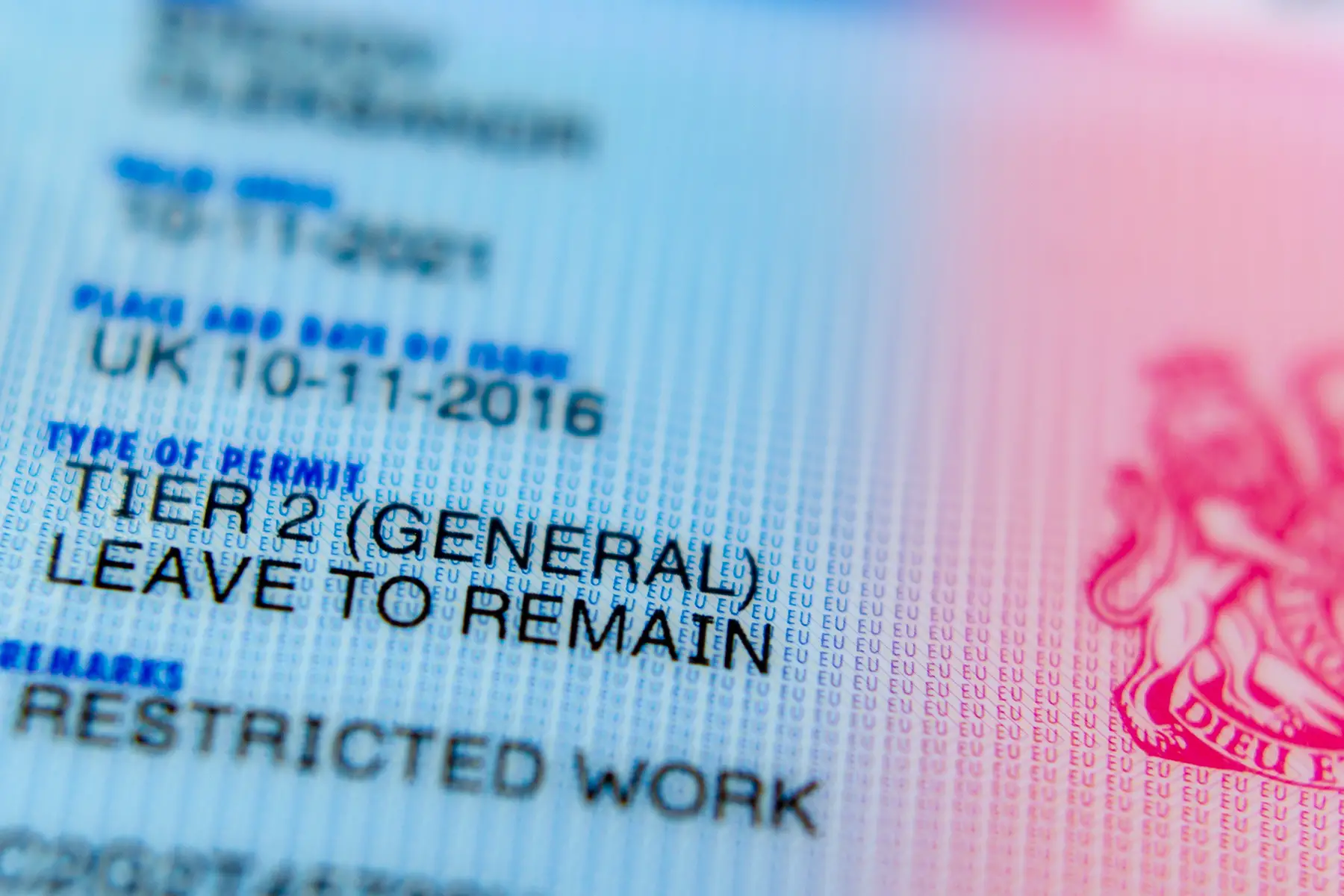

Foreign workers – your right to work in the UK

The UK has a points-based immigration system for foreign workers. Since Brexit and the withdrawal of the UK from the EU on 31 December 2020, this also applies to EU/EFTA citizens.

Workers from overseas will typically need a work visa to work legally in the UK. You can get these at the moment for skilled work, specific forms of temporary work or to start your own business. You usually need to have a job offer from a prospective employer. Foreign students in the UK can work while they are studying.

Employment contracts in the UK

All UK employees should receive a contract of employment that forms the basis of their relationship. Employment law in the UK states that employers should provide employees with employment contracts within two months of starting work. However, in practice, many workers in the UK never receive a written contract. You have a legal right to a written contract from your employer so you can ask them for one if you haven’t received anything.

Employment contracts in the UK include both express and implied terms. Express terms are explicitly agreed terms such as:

- Job title or job description

- Date the employment began and place of work

- Amount of pay and interval between payments

- Hours of work, holiday pay and sick pay entitlements

- Pension arrangements

- Notice period

- Grievance and appeal arrangements

- Disciplinary rules or dismissal procedures

Implied terms include statements concerning such things as both parties have a duty to trust and respect each other and behave in a reasonable manner.

The main types of UK contracts are:

- Open contracts, which can be full-time or part-time, which are not for any particular period of time. The contracts should clearly state the notice period on both sides along with terms of dismissal.

- Fixed-term contracts, which are generally the same as open contracts but will state how long the contract lasts for or give an end date.

- Zero hours contracts, which are commonly used for casual work. These contracts don’t guarantee any number of hours per week. However, employees are still entitled to minimum wage pay and annual leave. They also have the right to look for and accept work elsewhere.

- Freelancer contracts. These are slightly different as workers are self-employed and take care of their own tax and National Payments.

Most changes to an employment contract need the agreement of both employee and employer. You can find template employment contracts on the ACAS website.

Wages and salary in the UK

Most workers in the UK should earn at least the national minimum wage per hour. The minimum wage varies across age groups and changes each year. As of 1 April 2021, minimum hourly rates are:

- Apprentices – £4.30

- Workers aged under 18 – £4.62

- Aged 18-20 – £6.56

- Employees aged 21-22 – £8.36

- Aged 23 and over – £8.91 (National Living Wage)

You’re not entitled to the UK minimum wage if you’re self-employed. The situation is also different for some trainees and interns. You should get legal advice if you are concerned about this, or visit your nearest Citizens Advice center.

You can use the government’s National Minimum Wage calculator to check if you’re getting what you should be.

Payments occur either each week or each month. Many employers arrange for direct payments to your bank account. By law, you should also receive a payslip for each payment.

Employers in the UK do not have to pay for overtime. In fact, unpaid overtime is common in the UK. According to research, UK employees worked £24 billion worth of unpaid overtime in 2020. Your employment contract should state rules around overtime and whether you will receive payment. However, your average earnings including overtime cannot fall below minimum wage and your employer cannot force you to work more than an average of 48 hours per week.

Find out more in our guide to UK wages and salaries.

Work hours in the UK

Employment law in the UK sets out the maximum number of hours a person should work each week. For most UK workers, this is 48 hours a week. You can choose to work more than this but your employer cannot force you to do so. Employees aged under 18 should not be made to work more than 40 hours a week or eight hours a day.

Workers in the UK should also get sufficient rest breaks. For most employees working more than six hours a day, this is a minimum 20-minute break somewhere during the shift, at least 11 hours’ rest between each shift, and the equivalent of at least one day off a week. For employees aged under 18, this is increased to a 30-minute break during the shift, 12 hours between shifts, and two days off a week.

Employees in the UK also have the right to request time off work, a reduction in hours, or a change in hours due to personal circumstances. This should be written into your contract, although depending on your situation, you may not be paid for time taken off.

You should have holiday leave and parental leave entitlements written into your contract. Additionally, you can request time off for things such as public duties, studying, healthcare, or family emergencies. You can also request flexible working hours if your personal situation changes at any point.

Paid and unpaid leave in the UK

Holiday pay in the UK

All workers have a statutory right to at least 28 days of paid annual leave if working five days a week or more. If you work fewer than five days, your holiday entitlement is scaled down accordingly. Your employer may offer more than your minimum right to paid holiday. The main things you should know about holiday rights are:

- You start building up holiday entitlement as soon as you start work

- Your employer can control when you take your holiday

- You get paid your normal pay for your holiday

- When you finish a job, you get paid for any holiday you’ve not taken

Some employers run annual leave periods according to the calendar year (Jan-Dec), some according to the tax year (Apr-Mar) and some according to the school year (Sept-Aug). Your contract should have details of this. Sometimes employers will allow you to carry over unspent annual leave into the following year and some will allow you to “cash in” holiday entitlement for extra salary. However, this is not the norm in the UK so check in advance to avoid losing untaken leave.

In order to qualify for the right to annual leave, you need to be classed as a worker. If you’re self-employed, you have no statutory right to paid annual leave.

You do not have a statutory right to paid leave on bank and public holidays. If you get paid leave on a bank or public holiday, this may count towards your minimum holiday entitlement. There are eight permanent bank and public holidays in Great Britain (England, Wales, and Scotland) and ten in Northern Ireland.

Maternity/paternity pay in the UK

If you’re having a baby in the UK while employed, you can take paid maternity leave of up to a year. Maternity leave can start anytime 11 weeks before the due date. You can decide how much leave you take. Your employer has to offer you the same job on the same (or better) conditions if you take 26 weeks or less. If you take longer, they can offer you a different job if it’s at least the same conditions/pay, your old job no longer exists and you can do the new job.

You will get maternity pay while on maternity leave. The minimum statutory pay is for 39 weeks; 6 weeks at 90% of your normal salary and 33 weeks at either £151.97 a week or 90% salary (whichever is lowest). You may get more than this if your employer has agreed to pay additional contractual maternity pay, plus you may be entitled to maternity allowance.

When you return to work, you can request part-time or flexible hours if you wish. Your employer doesn’t have to grant this, however, they will need to give a good reason if they refuse it.

Fathers in the UK can take up to two weeks of paid paternity leave at either £151.97 a week or 90% salary (whichever is the lowest). Paternity can start anytime from the birth but has to end no later than 56 days after the birth (or due date if the birth is premature). In certain circumstances, parents can take shared parental leave.

Sick pay in the UK

If you’re off ill from work for any reason, you can get statutory sick pay in the UK. To claim sick pay, you need to be off work for four days in a row, not be in an ineligible category and follow the sick pay rules. You may need to provide a doctor’s note if ill for seven days or more. The situation may be different if you are on a temporary or zero hours contract, so check with your employer. You don’t get sick pay if self-employed.

Statutory sick pay is currently £96.35 a week for a maximum of 28 consecutive weeks. However, many UK employers may offer contractual sick pay. This is a more generous amount that may even be a 100% salary reimbursement. This is unlikely to be for a long-term period. Check your employment contract for details. If your contractual sick pay period ends, you can still claim statutory sick pay for up to 28 weeks from point of sickness.

Unpaid leave in the UK

You can choose to take unpaid leave from your job in the UK. How long you can take depends on the reason for taking leave. Reasons include:

- Parental leave, up to 18 weeks in total for each child up to their 18th birthday.

- Dealing with an emergency relating to family or any dependants.

- Performing public duties, for example jury duty.

- Taking time off for study or training. Your employer doesn’t have to grant this.

- Time off for health treatment. Again, this is at the employer’s discretion as they are not obliged to grant this.

If you want to request a period of unpaid leave, you should speak to your employer as soon as possible. Employers only have to grant unpaid parental leave if you give at least 21 days’ notice.

Parental rights in the UK

Parents and expectant parents have a few extra workplace rights in the UK. If you are pregnant, you have the right to take paid time off for antenatal appointments. Your partner also has the right to paid time off to accompany you, although many agency workers have to have been working in the job for 12 weeks to get this.

Pregnant workers also have enhanced health and safety rights, for example, protection against working long hours or from performing physically demanding work. If you are breastfeeding or are within 26 weeks of giving birth, you continue to have these rights.

Unlike in some other European countries, UK workers don’t have a legal right to additional breaks for breastfeeding. However, employers must provide sufficient “rest space” for breastfeeding parents. If you are breastfeeding, you also have the right to flexible working hours and protection against workplace harassment.

See the Maternity Action website for more information on breastfeeding at work.

Social security and tax in the UK

Social security in the UK is covered through employee National Insurance (NI) contributions deducted directly from wages and done through unique worker NI numbers. NI contributions cover:

- State pension

- Unemployment benefit (called Jobseeker’s Allowance in the UK)

- Employment and Support Allowance

- Maternity Allowance

- Bereavement support payment

Employees in the UK make Class 1 (automatically deducted from wages of anyone earning over £184 a week) and Class 3 (voluntary top-up payments) NI contributions. Self-employed workers in the UK make Class 2 and Class 4 payments. Current rates for Class 1 contributions are 12% for earnings of between £184-967 a week, and 2% for earnings above £967 a week.

Like NI payments, income tax contributions are deducted straight from salary through the Pay As You Earn (PAYE) system. You don’t need to fill in an annual tax return in the UK unless you are self-employed or earn additional income on top of your salary.

Current income tax rates for most of the UK are 20% on earnings above £12,750, 40% on earnings above £50,270, and 45% on earnings above £150,000.

Protection from discrimination at work in the UK

The UK protects against discrimination in the workplace through the Equalities Act 2010. This covers discrimination related to age, gender, ethnicity, sexual orientation, disability, religion, marital status, or being pregnant.

Discrimination law protects against unfair treatment regarding recruitment, dismissal, employment terms, promotion, training, and redundancy. UK law recognizes four types of discrimination:

- Direct discrimination, which is treating someone unfairly on the basis of certain characteristics

- Indirect discrimination, which is putting rules or procedures in place that may disadvantage or be a barrier to certain groups

- Harassment

- Victimization, which is treating someone unfairly because they’ve complained about discrimination

If you feel you have been discriminated against in the workplace, you should try and sort it out first through your employer. You can speak to the Human Resources department if your employer has one. If this doesn’t work, you can take legal action through an employment tribunal. You can also contact Citizens Advice or ACAS.

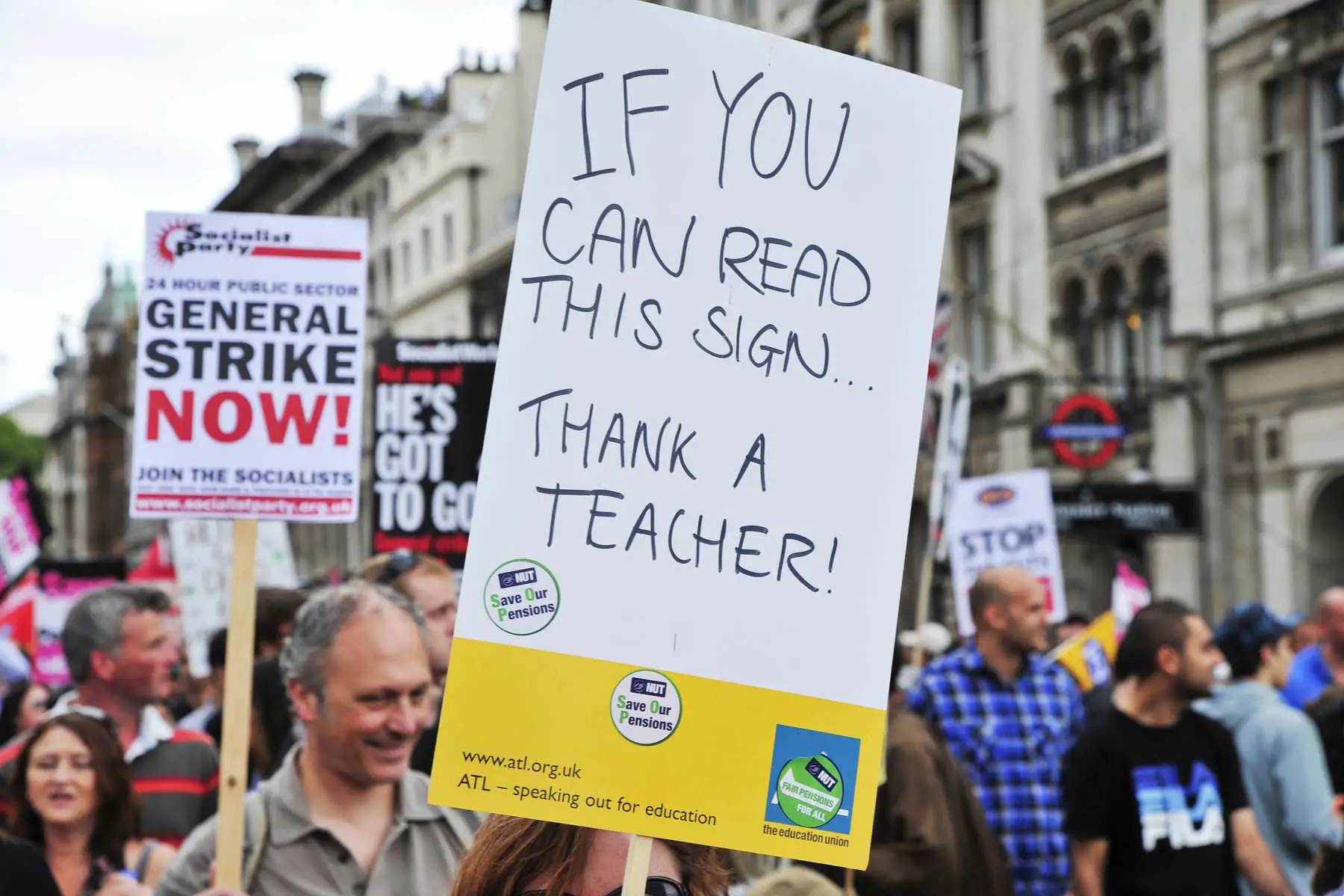

Joining a union in the UK

Around 23.5% of the UK workforce belongs to a trade union, although this figure is much higher in the public sector. Every employee has a right to join a union under employment law in the UK. You can choose which union you join. There are three types of unions in the UK: industry-related unions (e.g. teachers’ unions); unions linked to companies; and merged unions.

Merged unions are the largest UK unions. The three largest – Unite, UNISON and GMB – account for over 50% of UK union membership. The Trades Union Congress (TUC), the UK confederation of unions, has a website tool to help you find a union suitable for you.

If you join a trade union, you will have to pay a membership fee. This can be as little as around £2-3 a week. Workplaces typically have a union representative who you contact if you have a dispute.

Unions work through representing their members and collective bargaining with employers, or employer representative bodies, on issues such as pay and worker rights. Occasionally, unions may take industrial action (strikes). If you belong to a union, your employer cannot stop you from going on a strike that has been properly voted for by the membership. However, they don’t have to pay you for any period not worked.

Terminating the employment relationship in the UK

Dismissal

If an employer asks you to leave your job, whether or not they have to give you a minimum notice period depends on your contract. Standard notice periods vary from one week to three months. Notice periods often increase the longer you’ve been in the role. You have the right to ask for a written notice of dismissal from your employer.

Your employer can only dismiss you if they have a good reason. Valid reasons according to employment law in the UK are:

- Not being able to do your job properly or to an acceptable standard

- Gross misconduct, for example if you physically assault someone (in certain instances of this, your employer can dismiss you without a notice period)

- Persistent long-term illness that makes it impossible to do your job

- Redundancy

- If continuing to employ you would break the law, for example if you are a taxi driver and you lose your driving license

- If it’s impossible to carry on employing you, for example if the business stops trading for any reason

In situations where you feel you have been unfairly dismissed, you can challenge the decision through an employment tribunal.

Leaving a job voluntarily

You can resign from your job at any time, however, you may have to serve out a notice period that should be detailed in your contract. This often increases the longer you’ve been in the role. If you leave without serving your notice period, your employer can deduct the time not worked from your final pay packet.

When you resign from a job, it’s a good idea to do so in writing outlining the reasons for leaving and what date you would like to leave. You can speak to your boss first but putting it in writing makes it official and provides a formal record of your resignation.

You can sometimes resign on the grounds of constructive dismissal. This is where your employer has done something that seriously breaches the terms of the employment contracts. You can leave without giving notice and make a claim at an employment tribunal.

Redundancy

Redundancy happens when employers need to lay off workers due to scaling down, closing down, or restructuring. Redundancies need to be done in a fair way, for example on performance or length of service rather than in a discriminatory way based on someone’s age, ethnicity, etc. Employers will often use the “last in, first out” method. They may also ask if anyone wants to take voluntary redundancy.

You may be offered another job, or the chance to apply for another job, within the organization. However, you lose your entitlement to redundancy pay if you are re-employed.

You can get statutory redundancy pay in the UK if you have been in the job for two years. Current rates are:

- Half a week’s pay for each full year worked when aged under 22

- One week’s pay for each year worked aged 22-41

- 1.5 week’s pay for each year worked aged over 41

Statutory redundancy pay in the UK is capped at £16,320 and isn’t subject to taxation.

Notice periods for redundancy in the UK are:

- One week for employees working between one month and two years

- One week for each year worked between 2-12 years

- 12 weeks for employees working more than 12 years

Retirement

The state pension age in the UK currently depends on when you were born. It was set at 65 for both men and women in 2018 and is due to rise to 67 by 2028. You can check your state pension age in the UK using this government tool.

You can pay as much into as many UK pension schemes as you want and you can also retire early and start drawing on private pensions before retirement age. Many people also choose to work past their retirement age in the UK. You can defer your state pension but won’t need to make any further NI contributions if you work beyond your retirement age.

Company mergers and insolvencies in the UK

If the company you work for is taken over or merges with another company, your rights as laid out in your employment contract transfer automatically under the Transfer of Undertakings (Protection of Employment) Regulations 2006 (TUPE). However, TUPE doesn’t require the new employer to match any workplace pension arrangements in place.

In the event of your employer going bust and being unable to pay outstanding money owed to workers, you can apply to the UK government any wages, redundancy, and holiday pay the company owes.

Temporary, part-time, agency, and informal workers in the UK

Part-time workers have the same rights that full-time workers have under employment law in the UK, including equivalent pay rates, holidays, and training opportunities. The exception is in areas where it may disproportionately affect the employer, for example offering health insurance benefits.

Agency workers have the same basic rights such as the right to minimum wage and statutory holiday pay. However, they don’t have certain rights such as maternity leave. If you work through an agency, you probably won’t get a full employment contract but you should receive a written statement of employment outlining the key details and terms.

Once an agency worker has been employed by a company for 12 weeks, they have the same rights as a full employee.

Casual workers, such as those on zero-hour contracts, are often classified as self-employed workers. This means that the employer isn’t responsible for things such as minimum wage and holiday pay. You should still get a written agreement that states the terms. If your employer refers to you as an employee rather than a self-employed contractor, then you have full employment rights.

Making a complaint as a worker in the UK

If you want to raise a grievance with your employer about any matter, you should take the following steps:

- Speak to your employer. This could be speaking to your manager or going through the HR department. You can do this in writing if you prefer.

- If the situation doesn’t get resolved, you can contact your trade union if you are a member. Otherwise, you can get advice on best next steps to take from Citizens Advice.

- The next step is to contact the Advisory, Conciliation, and Arbitration Service (ACAS). They will offer you a free early conciliation service to try and settle matters before going through the courts.

- Finally, you can take things to an employment tribunal. This may involve attending a hearing, getting legal help, and arranging witnesses. If you win the case, your employer usually has 28 days to implement the court decision. If you lose, you can ask for a reconsideration or apply to the Employment Appeal Tribunal. However, you will need a very strong case for the original verdict to be overturned.

Useful resources

- GOV.UK – UK government website with information on jobs, working and employment law in the UK

- Advisory, Conciliation, and Arbitration Service (ACAS) – offers free impartial advice on workplace issues.

- Citizens Advice – Free advice service for UK residents.