Singapore‘s booming economy and high standard of living have made it a popular destination for global talent. But before you sign the dotted line, it’s a good idea to familiarize yourself with the country’s labor laws and learn what you are entitled to.

Discover the key essentials of workers’ rights in Singapore by reading the following sections:

- Labor law in Singapore

- Rights of foreign workers in Singapore

- Overview of employment contracts

- What is the basic salary in Singapore?

- What are typical Singapore working hours?

- What is mandatory paid and unpaid leave?

- Parental rights under Singapore’s labor law

- Singapore’s social security and tax system

- Protection from workplace discrimination

- Can you join a union in Singapore?

- Health and safety at the workplace

- Training and development in Singapore

- Terminating an employment relationship

- Company mergers and insolvencies in Singapore

- Temporary, part-time, agency, and informal workers

- Making a complaint as a worker in Singapore

- Useful resources

Labor law in Singapore

One of the secrets behind Singapore’s thriving economy may well be its successful implementation of tripartism. This system is based on collaboration among unions, employers, and the government and enables a social dialogue between all parties involved.

Tripartite agreements are a key competitive advantage in practical labor law as they cover wages and working conditions, as well as legislative policies on things like benefits, holidays, and work hours.

Singapore’s main labor law is the 1968 Employment Act. It provides the country’s basic working terms and conditions, like minimum working hours and rest days. It applies to most employees in Singapore, including temporary, contracted, and foreign workers.

Other legislative sources that protect employment rights and labor standards are:

- The Child Development Co-Savings Act (CDCA) – outlines maternity and paternity benefits

- The Employment of Foreign Manpower Act (EFMA) – protects the well-being of foreign employees

- The Retirement and Re-Employment Act (RRA) – outlines the retirement age and allows for re-employment

- The Work Injury Compensation Act (WICA) – enables employees to make claims for work-related injuries

- The Workplace Safety and Health Act (WSHA) – cultivates healthy work environments

The Ministry of Manpower (MOM) is responsible for labor law and maintaining work standards in Singapore. The Foreign Manpower Management Division (FMMD) enforces foreign workforce policies and is responsible for workplace standards for international employees.

How are Singapore’s labor practices viewed internationally?

On an international level, Singapore scores – surprisingly – rather poorly when it comes to labor laws. According to the 2022 Labor Rights Index (LRI), which surveys labor legislation worldwide, the country has a Total Lack of Decent Work.

With an overall score of 46.5 out of 100, Singapore ranks lower than the regional average of 62.33. The highest score observed in Southeast Asia is for Vietnam (75). While Singapore gets top marks on work safety, and child and forced labor, the LRI argues the country lacks proper legislation regarding employment security, social security, and trade unions.

Likewise, the 2023 Global Rights Index notes that industrial action is heavily regulated, and retaliation against striking workers is not legally prohibited.

Compared to other countries, the country’s work-life balance could also do with some improvement. Singapore regularly ranks as one of the world’s most overworked nations. As a result, many employees feel they are on the precipice of burnout and report overwhelming and crippling levels of stress within the workplace.

Rights of foreign workers in Singapore

Expats and international workers are essential to Singapore’s labor force. In 2023, the country issued 1.4 million foreign worker permits; that’s roughly one-quarter of the total labor market.

Each foreign national must hold a valid work visa (or work pass) to work and live in Singapore. There are several types of work visas for a wide range of professions, including artists, entrepreneurs, investors, and journalists. These permits can be valid for any period from 60 days to five years. In many cases, employers must apply on the behalf of their new hire. In practice, this almost always means you must find a job before coming to Singapore.

Eligible expats under the age of 25 may also apply for the work holiday visa program. This allows students and young graduates who studied in selected countries – including Australia, France, Japan, Switzerland, and the UK – to travel to Singapore and work for up to six months without securing a job in advance. The program is not meant for finding full-time employment, and there are very few reports of Work Holiday Passes being converted to regular work visas.

Under the Singapore labor law, foreign workers have the same statutory rights as citizens. Exceptions exist only for seafarers, domestic workers, board employees, and civil servants.

Overview of employment contracts

Employment contracts in Singapore can be written or verbal, with written agreements being the favored option as they are far easier to prove and enforce (in case of a legal battle). They’re also convenient for visa processing.

Employment contracts are typically written in English, but there is no legal obligation to do so. That’s because English is only one of four national languages in Singapore (the others being Mandarin, Malay, and Tamil).

Employers are free to draw up contracts as they choose, as long as the terms are not less favorable than what’s outlined in the Employment Act. In general, work agreements should include the following:

- Employer’s name and organization

- Employee’s name

- Job description and duties

- Start date

- Salary and benefits

- Working hours

- Termination procedure

Probation period in Singapore

Most employees will start their jobs on a trial basis. The probation period usually lasts 3–6 months but may be extended by the employer. The exact duration will be stated in your employment contract.

After that, you’ll likely transition to regular employment (pending a review). However, you or your employer may terminate your working relationship during or after the trial period, as stated in the job contract.

Your probation does not affect your entitlement to annual leave or sick leave. That said, if you don’t show up for work most days, your chances of getting regular employment will probably be slim.

Length of employment contracts

Singapore has two main contract types:

- Term contracts – also known as fixed-term contracts, these agreements have a fixed end date. They’re commonly used for project-based work, seasonal jobs, freelancing, or temporary staff hiring projects.

- Indefinite-term contracts – these are open-ended agreements that continue until one party terminates it. They’re also known as permanent contracts and can be full-time or part-time.

It’s more common to get an indefinite-term employment contract in Singapore. They are seen as offering greater security to both the employer and the employee.

What is the basic salary in Singapore?

Singapore does not have a universal minimum wage. Instead, salaries reflect market supply and demand. However, there are a few measures and regulations in place to ensure certain low-earning jobs are compensated fairly.

The government regularly conducts research into fair wages. In September 2023, they stated that S$2,906 per month would be a “reasonable starting point” for a living wage in Singapore.

Because of that, citizens over the age of 30 who earn less than S$2,500 per month qualify for the Workfare Income Supplement (WIS) scheme. This program offers an income supplement in the form of cash payments and additional contributions to Singapore’s social security system, called the Central Provident Fund (CPF).

What is the Progressive Wage Model?

The Progressive Wage Model (PWM) mandates a basic monthly salary for selected low-paying sectors. The model comprises wage ladders for broad employment categories, which account for the most common jobs in that sector. By law, workers must be paid at least the stipulated PWM wages according to their skills and employment level (e.g., entry or senior).

PWM applies to the following sectors:

- Administration

- Cleaning

- Driving/Chauffeuring

- Elevator (lift) and escalator (L&E)

- Food services

- Landscaping

- Retail

- Security

- Waste management

The wage levels will be readjusted every year. Employees can check if they are paid the correct salary on the Progressive Wage (PW) Portal.

From 2022 to 2026, the Singapore government is subsidizing eligible wage increases for lower-wage workers through the Progressive Wage Credit Scheme. Entitled employers don’t need to apply for the PWCS but will receive a payout automatically.

What is the Local Qualifying Salary?

Depending on the sector, companies in Singapore must hire a specific quota of local workers before they can hire foreigners.

To ensure organizations hire local employees purposefully and don’t offer them token salaries (so the corporation can meet the quota and access foreign workers), the government has implemented the Local Qualifying Salary (LQS). This regulation determines a minimum wage of at least S$1,400 per month for Singapore permanent residents and citizens.

The LQS is reviewed regularly to keep up with rising local wages and ensure that the quota controls remain effective.

What is the Annual Wage Supplement?

The Annual Wage Supplement (AWS) is a bonus that some employers pay to their workers. It’s comparable to the 13th month salary.

AWS is not required by labor law in Singapore. As such, the amount and your entitlement to it will depend on your contract with your employer.

What are typical Singapore working hours?

A standard full-time working week in Singapore has 44 hours spanning five or six days. It is generally split as such:

- Less than five days – up to nine hours per day or 44 hours per week

- More than five days – up to eight hours per day or 44 hours per week

Employees are allowed to do overtime beyond the contractual hours. Labor law in Singapore stipulates that overtime should be paid at 1.5 times the average hourly rate.

Workers are also guaranteed one rest day per week. For shift workers, the rest day can be a continuous period of 30 hours. If you work only part-time, the days on which you don’t work do not count as rest days. Before the start of each month, employees should receive a monthly roster specifying rest days. The maximum interval between two rest days is 12 days.

Burnout is a growing issue among Singapore’s workers. The country is regularly named one of the world’s most overworked nations. As a result, many employees report overwhelming and crippling levels of stress within their workplace.

What is mandatory paid and unpaid leave?

Public holidays

Singapore workers are entitled to 11 paid public holidays per year. If a public holiday falls on your designated rest day, your paid vacation day starts the following day. Designated holidays include:

- 1 January: New Year’s Day

- Between 21 January and 20 February: Chinese New Year – day one

- Between 21 January and 20 February: Chinese New Year – day two

- Between March and April: Hari Raya Puasa or Eid al-Fitr

- Between March and April: Good Friday

- 1 May: Labor Day

- Between May and June: Hari Raya Haji or Eid al-Adha

- Between May and June: Vesak Day

- 9 August: National Day

- Between October and December: Deepavali

- 25 December: Christmas Day

You are entitled to your full gross pay rate on a paid public holiday. Exceptions exist only if you are absent before or after a holiday without good reason, or if you are already on authorized leave.

Employees who are required to work on a public holiday are entitled to an extra day’s pay, plus the gross rate of pay for that holiday. Alternatively, you can substitute the day off with another working day.

Paid time off (PTO) or annual leave

Both full-time and part-time workers are entitled to PTO or annual leave. The number of PTO days you have depends on how many years you’ve worked for your employer. It breaks down like this:

| Years employed | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| Vacation days per year | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 |

You must be with a company for at least three months before you can claim any vacation days.

Most workers are allowed to carry over up to 14 days of unused annual leave to the next year. If you are not covered by Part IV of the Employment Act, your employer can decide their own terms for unused PTO. For example, they can choose to let you encash it, carry it over, or forfeit it. You should check your employment contract and company policy to make sure you don’t lose any entitled vacation days.

To take time off, you should apply for it in advance. Management is then in their right to grant or deny you the chosen dates.

Do you get sick pay in Singapore?

By law, you become eligible for paid sick days once you’ve worked with a company for at least three months. You are then allowed up to 14 days of sick leave and 60 days of hospitalization leave. The 60 days of hospitalization leave includes the 14 days of paid sick days (so you really only have 60 days in total).

The number of days you’re entitled to depends on your time with the company:

| Months employed | 3 | 4 | 5 | 6 |

| Sick days per year | 5 | 8 | 11 | 14 |

| Hospitalization days per year | 15 | 30 | 45 | 60 |

To qualify for paid sick leave, you must be certified by a doctor to be unfit for work and contact your employer within 48 hours of your absence. Cosmetic procedures do not count for taking hospitalization days. During sick leave, you are entitled to full pay. You may also be eligible for Singapore’s social security to help reduce your medical costs.

Can you take unpaid leave in Singapore?

With the exception of unpaid infant care leave, there is no statutory entitlement to unpaid leave. Individual companies generally draft their own standard policies, so it’s good to check with your employer to see what their company policy is.

Parents of Singaporean citizens under the age of 2 are permitted 12 days of unpaid infant care leave per year, regardless of the number of children. They must have worked for the company for at least three months before taking the days off.

Parental rights under Singapore’s labor law

The rights of (soon-to-be) working parents in Singapore are protected by the Employment Act and the Child Development Co-Savings Act. You’re entitled to these rights if you’ve worked with your employer or have been self-employed for at least three months.

Married couples are eligible for the Baby Bonus Scheme when they give birth to a Singaporean citizen. This comes with a S$11,000–13,000 cash gift and Child Development Account (CDA) benefits, including a S$5,000 First Step Grant and a dollar-for-dollar Government co-matching initiative for each dollar the parents save in the child’s name.

You can find more information on the Ministry of Social and Family Development (MSF)’s website.

Your rights during your pregnancy

Singapore labor law protects expectant mothers from dismissal. A pregnant person may only be fired if:

- There was serious misconduct, unrelated to their pregnancy

- It is impossible to maintain an employment contract for reasons unrelated to the pregnancy (e.g., company closure)

- They received the notice of dismissal before being certified pregnant by a medical practitioner

If you feel you have been unfairly dismissed, you can take up a claim with the Tripartite Alliance for Dispute Management (TADM).

Other rights during your pregnancy include:

- If you are dismissed within six months of your due date, your employer must still pay your maternity benefits

- Your employer may not ask you to work during the first four weeks of the delivery

Parental and childcare leave in Singapore

There are several forms of parental and childcare leave for (self)employed parents, including:

- Maternity leave

- Paternity leave

- Adoption leave

- Shared parental leave

- Unpaid infant care leave

- Paid childcare leave

- Extended childcare leave

Maternity leave for (self)employed mothers

Working mothers are entitled to 16 weeks of Government-Paid Maternity Leave (GPML), or 12 weeks of maternity leave if the child is not a Singapore citizen. The weeks are divided into two periods: the prenatal (starting four weeks before your due date) and the postnatal period (lasting up to 12 weeks after delivery).

The default option is to take the full 12 or 16 weeks in one go. However, you and your employer can also mutually agree to spread it out over 12 months. In that case, you must take the first eight weeks of maternity leave in one block. The remaining weeks can be distributed over the year until your child’s first birthday.

Maternity pay leave depends on your family size and your baby’s nationality:

| Family size | Nationality | You are owed: |

| First or second child | Singaporean (or becomes one within 12 months of their birth) | – Your employer pays your usual monthly salary during the first eight weeks – The government pays you during the subsequent weeks, capped at S$20,000 in total |

| Third or subsequent baby | Singaporean (or becomes one within 12 months of their birth) | – The government pays you during the full 16 weeks, capped at S$40,000 in total |

| First or second child | Non-Singaporean | – Your employer pays your standard gross salary during the first eight weeks – The remaining weeks are unpaid |

| Third or subsequent baby | Non-Singaporean | – Your maternity leave is unpaid |

You must inform your employer of your maternity leave at least one week beforehand. Otherwise, you’ll only receive half the pay (unless there is a good reason for not giving prior notice, like a premature birth).

If you don’t qualify for GPML due to your employment contract (e.g., you have a temporary contract), you may be eligible for Government-Paid Maternity Benefits (GPMB).

Paternity leave for (self)employed fathers

In Singapore, some working fathers are entitled to four weeks of Government-Paid Paternity Leave (GPPL). Two of those weeks are required by law; the additional two weeks can be granted by your employer on a voluntary basis.

Requirements for GPPL include:

- Your child is a Singapore citizen or becomes a Singapore citizen before their first birthday

- You are or have been lawfully married to the baby’s mother between conception and birth, or within 12 months of the delivery

- If you are self-employed, you must prove loss of income during the weeks of paternity leave

You can take your weeks off at any time during the first 16 weeks following your child’s birth. With mutual agreement between you and your employer, you can also spread your paternity leave over the first 12 months after your baby is born.

The government pays working fathers their full salary, up to S$2,500 per week, including any CPF contributions.

If you don’t qualify for GPPL due to your employment arrangements (e.g., you have a short-term contract), you may be eligible for Government-Paid Paternity Benefits (GPPB).

Adoption leave for (self)employed parents

Eligible mothers can get 12 weeks of paid leave when they adopt a baby under the age of 12 months. Adoptive fathers may take up to four weeks of GPPL.

Contingencies for adoptive parents include:

- You are not the biological parent of the child

- Your child must be a citizen OR (if a foreigner):

- Become a citizen within six months of the adoption

- At least one of the adoptive parents must be a Singaporean citizen

- The adoption order must be granted within one year from the Formal Intent to Adopt (FIA)

- If you are self-employed, you must prove loss of income during the weeks of leave

You can claim your leave all at once from the date of the FIA or, if your employer agrees, spread it over 12 months. In the case of the latter, the mother must take the first eight weeks in one go, starting at any time between filing the FIA and being given the adoption order. The father can claim the two or four weeks off whenever.

The pay you’ll receive during this leave depends on your gender and family size:

| Parent | Family size | You are owed: |

| Mother | First or second baby | – Your employer pays your usual monthly salary during the first four weeks – The government funds the remaining eight weeks, capped at S$20,000 in total (including CPF contributions) |

| Mother | Third or subsequent child | – The government pays you during the entire 12-week period, with a maximum of S$30,000 in total (including CPF contributions) |

| Father | n/a | – The government pays your standard gross salary, up to S$2,500 per week (including CPF contributions) |

If you don’t qualify for adoptive leave, you may be eligible for Government-Paid Adoption Benefits (GPAB).

Shared parental leave for (self)employed parents

The Government-Paid Shared Parental Leave (SPL) allows married couples to share their parental leave with each other. If the mother agrees, eligible working fathers can get up to four additional weeks on top of their paternity leave. These weeks will be deducted from their wife’s GPML or adoptive leave.

Requirements for birth parents include:

- The child’s mother is eligible for and agrees to share her GPML

- You must be a lawfully married couple at the time of conception or within 12 months from the delivery

- Your child must be a citizen OR (if a foreigner):

- Must become a citizen within six months of the adoption

- At least one of the adoptive parents must be a Singaporean citizen

Contingencies for adoptive parents include:

- You have made a joint application to adopt your child

- The child’s mother is eligible for and agrees to share her adoptive leave

- You are or were lawfully married when the mother agreed to share the adoptive leave

- Your child must be a citizen OR (if a foreigner):

- Become a citizen within six months of the adoption

- At least one of the adoptive parents must be a Singaporean citizen

- The adoption order must be granted within one year from the Formal Intent to Adopt (FIA)

The government will pay fathers their full monthly salary, with a maximum of S$2,500 per week (including CPF contributions).

Parental leave for unemployed parents

Unfortunately, there is no specific parental leave or pay for unemployed workers in Singapore. In fact, the country’s ethos of self-reliance offers very few unemployment benefits in general. However, if your baby is a Singapore citizen, you’re still eligible to receive the Baby Bonus Scheme.

How to apply for any government-paid leave for parents

Salaried parents must notify their employer of their intended leave early so the company can make alternative work arrangements.

Depending on your leave, you must submit one of the following declaration forms with all necessary supporting documents:

If you are self-employed, you can apply online via the Government-Paid Leave (GPL) Portal, no later than three months after the last day of your government-paid leave. Note that self-employed persons must be able to prove loss of income.

For more information, you can visit the government’s ProFamilyLeave website.

Important notes regarding law-mandated leave for parents:

- Giving birth to twins or triplets is treated as a single delivery; you will not receive double or triple benefits

- If your baby is stillborn or dies shortly after birth, you’re still eligible for full maternity or paternity leave. However, a medical practitioner, a registered midwife, or the Immigration and Checkpoints Authority must certify a Notification of a Stillbirth.

- You are not entitled to additional pay if a public holiday occurs during your mandated leave

- Any leave for parents cannot be used to offset the notice period if you want to quit your job

- Unused leave cannot be carried over to the next year, the next child, or the next employer

- If you switch employment before claiming any unused leave, you are not entitled to monetary compensation

Returning to work after your parental leave

Singapore’s labor law does not specifically deal with parents returning to work. It is up to the parent and company to negotiate lighter workloads, shorter schedules, or adapted workplace roles.

The Ministry of Health has issued guidelines for new working mothers and outlines what you may expect in the office. In recent years, there has been an increased call for more breastfeeding spaces in offices and public buildings. As a result, businesses are being encouraged to become more supportive of working mothers.

What to do if your child gets sick?

Unpaid infant care leave for employed parents

If your child is a Singaporean citizen below the age of 2, you are entitled to 12 days of Unpaid Infant Care Leave per year. This is in addition to any employer or government-paid leave (including adoption leave).

It’s worth noting that biological fathers are not eligible for UICL if they and/or the child’s biological mother were lawfully married to someone else (a third party) at the child’s conception and have not subsequently married each other.

Adoptive parents can only take leave without pay after the Adoption Order has passed.

If you don’t meet the criteria, your company may have organized its own unpaid leave policies for new parents.

Paid childcare leave for (self)employed parents

Singapore labor law stipulates that working parents must have access to a certain number of days of paid childcare leave per year, depending on their situation.

| Nationality of the child who needs care | Age of your youngest child | Days you are entitled to per year | Pay |

| Singaporean | Age below 7 | 6 days of Government-Paid Childcare Leave (GPCL) | – Day 1–3 is paid by your employer, at your gross pay rate – Day 4–6 is funded by the government, capped at $500 per day |

| Singaporean | Age 7-12 | 2 days of Extended Childcare Leave (ECL) | Paid by the government, capped at S$500 per day, including CPF contributions |

| Non-Singaporean | Age below 7 | 2 days of childcare leave | Funded by your employer, at your gross pay rate |

If you work part-time, you are entitled to days of childcare leave based on your work schedule.

It’s important to note that biological fathers are not eligible for GPCL or ECL if they and/or the biological mother were lawfully married to someone else (a third party) at the child’s conception and have not married each other since.

Adoptive parents can only take leave without pay after the Adoption Order has passed.

Singapore’s social security and tax system

The Central Provident Fund is the main pillar of Singapore’s social security system. Employees and employers make monthly CPF contributions, which fund pensions, public healthcare, and social housing.

The CPF applies to Singaporean citizens and permanent residents only; foreign workers do not and cannot voluntarily contribute to or benefit from CPF. Instead, they may pay into a Supplementary Retirement Scheme (SRS) or take out private health insurance.

The maximum CPF contribution rate is 37% of your salary. Employees contribute 5–20% of their wages, and employers match it with 7.5–17%. The percentage you must contribute depends on your age and earnings. Rates lessen once you reach the age of 55.

In 2024, contributions are capped based on a maximum monthly earnings of S$6,800. This cap will increase to S$7,400 in 2025 and S$8,000 in 2026.

In Singapore, Mandatory social security contributions are not part of your taxable income, but any voluntary contributions are.

All employees must pay 0-22% tax on their taxable income, with non-residents paying a higher flat rate of 15–22%. The Inland Revenue Authority of Singapore (IRAS) oversees this tax system.

Protection from workplace discrimination

At the time of writing (February 2024), Singapore has no binding legislation that prohibits and tackles workplace discrimination. Instead, the Tripartite Alliance on Fair and Progressive Employment Practices (TAFEP) promotes fair and responsible hiring by setting non-binding guidelines.

For example, the Fair Consideration Framework (FCF) aims to prevent discriminatory hiring practices based on age, sex, nationality, race, and religion.

This is all set to change, however. Singapore is looking to pass its first-ever Workplace Fairness Legislation in the second half of 2024. This will create a more concrete path for filing complaints and claims to the Employment Claims Tribunal (ECT). Sadly, the proposed legislation on workplace discrimination still has gaps. For example, measures against LGBTQ+ discrimination will not be included.

You can report discriminatory hiring practices, workplace harassment, or job complaints directly to your company’s HR department or the TAFEP. Companies caught violating the non-binding guidelines could face temporary suspension for issuing foreigners’ work passes.

Can you join a union in Singapore?

The 1940 Trade Unions Act protects the right to join and establish a trade union in Singapore. With the exception of public servants, hospital personnel, port workers, and airline employees, workers have the right to strike and take industrial action as long as the majority votes in favor.

The National Trades Union Congress (NTUC) is the country’s sole trade union center. It represents about 80 unions, affiliated associations, and related organizations, and has a membership of over one million workers (2021). NTUC membership costs S$117 per year and offers additional benefits, such as rebates and wage negotiations.

Together with the NTUC and the Singapore National Employers Federation, the government has formed the Tripartite Alliance for Fair and Progressive Employment Practices (TAFEP). This partnership promotes fair, responsible, and progressive work practices. One outcome of this collaboration is the aforementioned Progressive Wage Model.

TAFEP also provides tools, resource materials, and assistance to employers who want to improve their workplaces, and helps employees who experience workplace discrimination or harassment.

It should be acknowledged, however, that some international watchdogs question the effectiveness of Singapore’s unions. For example, the Global Rights Index notes that:

- Trade unions require prior authorization before being established

- Existing unions must undertake mandatory arbitration, conciliation, and mediation before any action is permitted

- The right to collective bargaining is recognized by law but strictly regulated

- Workers and unions involved in non-authorized strikes face excessive civil or penal sanctions

Due to various Public Order Acts, Societies Acts, and Criminal Procedure Codes that heavily regulate worker strikes, industrial action is very rare in Singapore. The country also lacks legislation that prohibits retaliation against strikers.

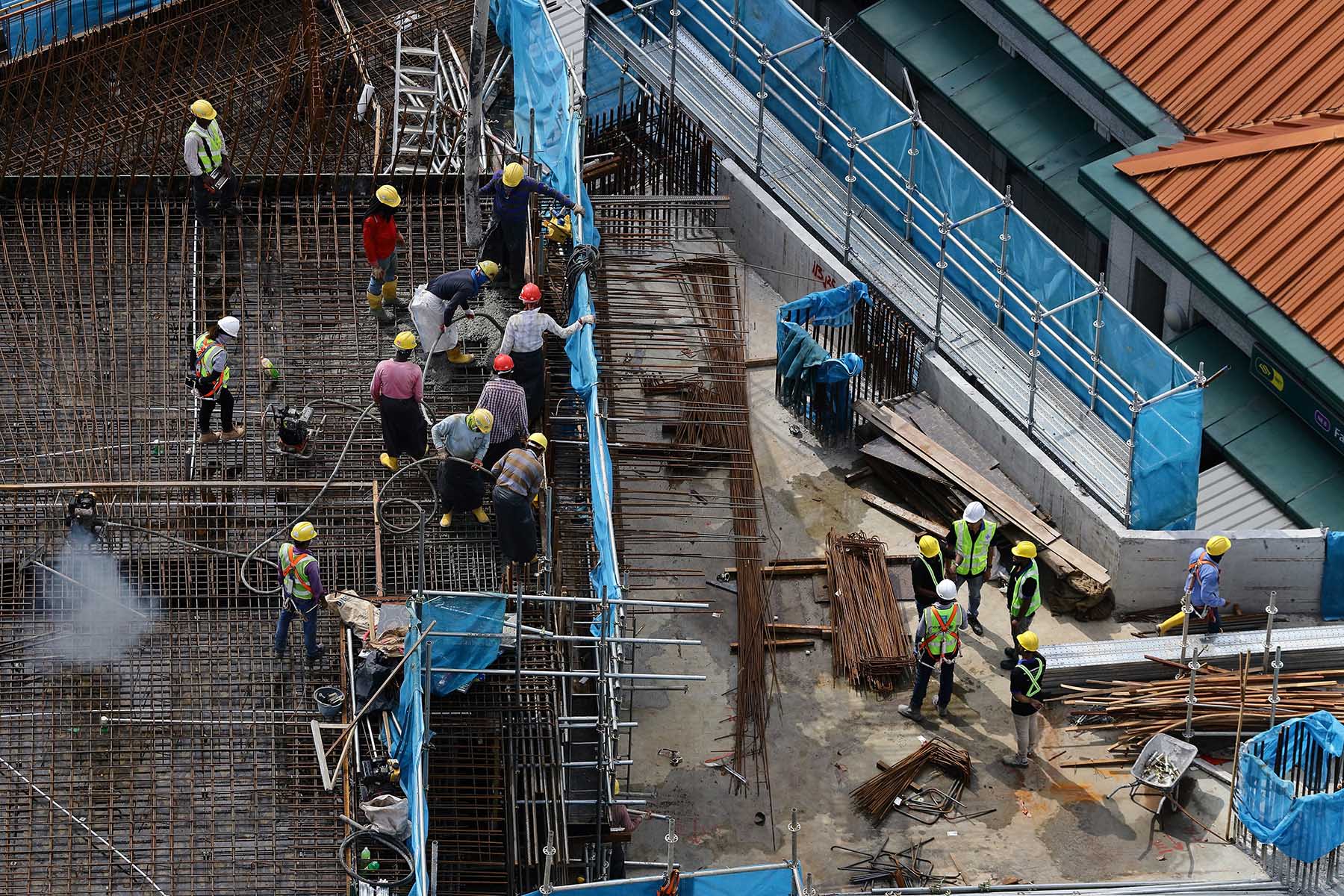

Health and safety at the workplace

The Workplace Safety and Health Act (WSHA) and Work Injury Compensation Act (WICA) legislate the country’s workplace health and safety laws. These acts cover employees’ physical and mental well-being, provide compensation for workplace injuries, and hold employees responsible for workplace safety.

Companies may face fines of S$2,000 per safety lapse. Authorities can impose a maximum fine of S$50,000 in more severe cases.

While workplace safety breaches are extremely rare in Singapore, most occur in high-risk environments like construction sites. In 2023, there were only 36 workplace fatalities, a 21.7% drop from the previous year.

To promote improvements to health and safety at work, the StartSAFE program monitors and assesses small to medium-sized businesses to meet WSHA demands. You can check a company’s safety profile using the government’s online tool. Likewise, if you have a health and safety concern at work, you can contact your union or report the issue directly through the MOM.

Training and development in Singapore

Employers are not legally required to arrange training or development. However, the Ministry of Manpower actively encourages companies to provide their employees with opportunities for education and training for career advancement.

There are also several subsidies and projects to cover the costs of work-related training for both employers and employees. One such project is SkillsFuture Singapore (SSG), which offers work-study programs for new graduates and enterprise credit for small businesses.

Terminating an employment relationship

Dismissal

An employer can terminate a contract by giving a prior written notice. Under Singapore labor law, they are not legally obligated to provide a reason for dismissal.

The job contract typically outlines the company’s notice period. However, if it doesn’t specify a time frame, the law mandates a set notice period depending on your length of service:

| Length of service | Less than 26 weeks | 26 weeks to 2 years | 2–5 years | 5 years or more |

| Notice period required | 1 day | 1 week | 2 weeks | 4 weeks |

An employer does not have to give prior notice if:

- You are guilty of misconduct

- You breached the employment contract

- They offer you compensation in lieu of a termination period (i.e., notice pay or a severance package)

For more information on job terminations (for example, what happens to unused annual leave), you can visit the MOM website.

Workers in Singapore do not have a statutory right to severance pay. The company is entirely free to set its own terms; this will be mentioned in your job contract.

If you feel you have been wrongfully dismissed, you can submit a claim with the TADM or file an appeal with the MOM. You must do this within a month of your termination. Examples of wrongful dismissals include:

- Discriminatory grounds (e.g., age, race, gender, religion, and disability)

- Grounds to deprive an employee of benefits (e.g., maternity leave)

- Retaliatory grounds, such as following mediation requests against the employer

Leaving a job voluntarily

You can resign from a job in Singapore at any time, subject to the notice period outlined in your employment contract. If the contract doesn’t specify a time frame, the required notice period depends on your length of service:

| Length of service | Less than 26 weeks | 26 weeks to 2 years | 2–5 years | 5 years or more |

| Mandated notice period | 1 day | 1 week | 2 weeks | 4 weeks |

An employer cannot reject your resignation. You may use unused annual leave to offset the notice period or pay your employer compensation. The notice can also be waived if both you and your employer agree.

You must submit your resignation in writing. It’s also recommended that you ask your employer to sign the termination letter to acknowledge receipt. This can help prevent any potential issues later on.

Redundancy

The MOM and the Tripartite Advisory strongly discourage termination due to redundancy. However, it’s not prohibited.

Employers must give prior written notice, corresponding to the period outlined in the job contract (see above). They’re also required to offer redundancy pay (or retrenchment benefits) to long-term employees with at least two years of service. While Singapore labor law doesn’t specify the amount of the compensation, it’s usually between two weeks and a month’s salary per year of service.

It’s not mandatory to provide a severance package for workers with less than two years of service. However, the MOM recommends they also receive an ex-gratia payment as a sign of goodwill.

If the retrenched employee is over the minimum retirement age (63), they may be eligible to receive an Employment Assistance Payment (EAP). This is a one-off payment equivalent to 3.5 months’ salary, subject to a minimum of S$6,250 and a maximum of S$14,750.

Retirement

The minimum retirement age in Singapore is 63. You cannot legally be asked to retire before this age if you are a citizen or permanent resident or began working for your employer before turning 55.

The Retirement and Re-employment Act (RRA) requires companies to offer re-employment opportunities to eligible employees aged 63–68. Singapore labor law does not mandate a compulsory retirement age, so people can continue working as long as they want.

Eligibility requirements for re-employment include:

- You’re a Singapore citizen or permanent resident who is medically fit to continue working

- You’ve worked at least 2 years for your employer before turning 63

- Your work performance is satisfactory

If you qualify for re-employment but your employer is unable to offer you a position, they can:

- Transfer the re-employment obligation to another employer (you’re allowed to refuse this option)

- Offer you a one-off Employment Assistance Payment

Coincidentally, Singapore’s CPF public pension becomes available when the holder turns 65. This isn’t linked to the retirement age. You can start receiving monthly retirement payouts from the age of 65, even if you continue working.

Company mergers and insolvencies in Singapore

When your company merges or is acquired, you have the right to be automatically transferred and continue as employees of the new entity. Your new role should uphold the terms of your original working contract.

Foreign workers with an Employment Pass will not automatically get transferred with a company merger. As a result, you’ll need to apply for a new Employment Pass or write to the MOM for a transfer. However, this is never guaranteed, as some companies are legally required to post new job positions locally.

If your company goes bankrupt (i.e., insolvency), you are not entitled to any guaranteed compensation. However, the Companies Act does place outstanding salary claims as second on the priority list of creditors. This specifies that – if possible – an employee should receive up to five months’ salary for a sum of up to S$12,500.

Temporary, part-time, agency, and informal workers

Labor law in Singapore makes no distinction between temporary and contracted workers. As such, temporary and agency workers have the same basic employment rights as regular full-time workers. If you work less than 35 hours a week, you are considered a part-time worker, and you are entitled to different overtime terms.

Temporary and agency employees generally hold fixed-term jobs with different contracts. The maximum contract length for temporary work is usually one year.

Making a complaint as a worker in Singapore

If you have a problem at work, you can file a complaint with your employer. Most organizations have an HR department or equivalent grievance handling procedure that can solve any workplace issues.

If the matter cannot be resolved, you could escalate it to higher up and report it to upper management. In that case, you should always consult your union for advice.

For specific issues related to violations of Singapore labor law, you can submit complaints to:

Depending on its severity, your grievance may be dealt with through arbitration, mediation, or the courts.

Specific complaints related to migrant workers or workplaces can be filed with the Migrant Workers’ Centre (MWC). These will prosecute rogue employers in Singapore found to be breaking the country’s labor laws through the MOM.

Useful resources

- MOM – the government ministry responsible for workforce policies

- Work Passes – the types of passes and permits issued to work in Singapore

- Employment Act – Singapore’s main labor law

- NTUC – Singapore’s main union organization