If you’ve always dreamed of owning a home, Singapore is a fine place to settle. With high homeownership rates and government regulation and grants, the market is very attractive for permanent residents and citizens.

Prices are generally more costly for expats, and there are some restrictions you need to know. Learn what property you can purchase, the process for doing so, and any hidden costs you need to factor in.

Let’s dive in:

- An overview of Singapore’s property market

- Can expats buy real estate in Singapore?

- Buying vs renting in Singapore

- The cost of buying property in Singapore

- How to finance a property purchase?

- How to find real estate in Singapore?

- Where should you buy in Singapore?

- Buying a newly built home

- Building your own Singapore home

- Laws on renting out in Singapore

- Tips for moving into your new home

- How to sell real estate in Singapore?

- Useful resources

Wise

Buying a property abroad is a big step and involves important financial decisions. Wise, an international money transfer company, provides specialist support to help you navigate large international transfers and save on exchange fees. Fill out Wise’s online form today to find out how they can assist you.

An overview of Singapore’s property market

The Singapore real estate market has remained strong and stable for quite some time. Its market consistently outperforms others globally, even during the uncertainty of the COVID-19 pandemic. Historically, the country has effectively used public intervention, which helps to lessen the fears of property bubbles.

That said, despite government intervention, housing prices are rising. In 2021, private property prices rose by 10.6% and again by 8.6% in 2022. Some market analysts believe this uncomfortable inflation is the price the country has to pay for being a global heart of finance and commerce. Others expect property prices to drop in 2024, a downturn that may persist for two years.

Still, Singapore remains a strong property market with healthy initiatives and protections that benefit local citizens.

Homeownership in Singapore

Homeownership is every bit a part of the Singaporean dream, as in any other country. In fact, up to 89.3% of citizens own their property (2022). This compares favorably to averages in the European Union (70% in 2020) and the US (65.9% in 2022). Despite this, younger Singaporeans – particularly singles and young families – are struggling to buy a home.

The country’s high homeownership rates have much to do with the Housing and Development Board (HDB). This public housing program ensures that low and middle-income Singaporeans can access affordable real estate through grants and below-market prices. It is part of a general policy in Singapore to keep property markets low-cost and avoid speculation. Most homes (77.9% in 2022) are owned under an HDB system.

The average and median housing prices in Singapore (2023) are:

- HDB flats average around S$566,000 (the median is S$545,000)

- Condos are sold for an average of S$2 million (the median is S$1,7 million)

- Landed property prices average about S$5,6 million (the median is S$4,1 million)

Can expats buy real estate in Singapore?

The Residential Property Act regulates the type of properties expats can buy in Singapore:

- Privatized executive condos (the property must be over 10 years old)

- Private condo units

- Landed property in Sentosa Cove

- Landed properties with permission from the Singapore Land Authority (SLA)

While permanent residents are also considered foreigners, they are given more options for purchasing a home:

- Resale HDB flats (only if purchased jointly with another Singapore permanent resident. You must also hold residency for over three years.)

- Resale executive condos (the property must be over five years old)

- Privatized executive condo units (the property must be over 10 years old)

- Private condominiums

- Strata landed homes

- Landed property in Sentosa Cove

- Landed properties with permission from the SLA

Only Singaporean citizens are allowed to buy:

- HDB flats without restrictions

- Executive condo units without restrictions

- Landed property without permission from the SLA

Buying vs renting in Singapore

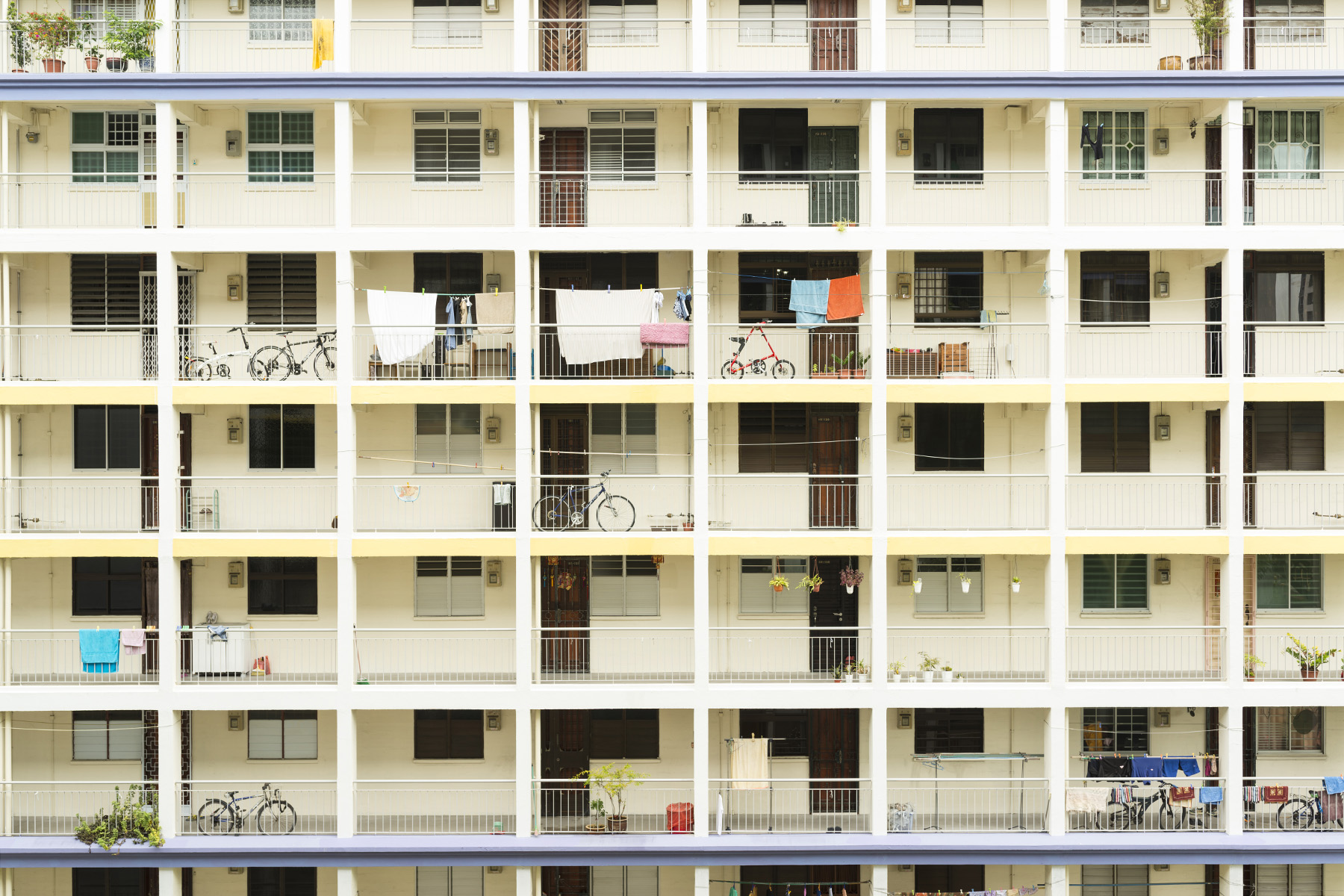

Most newcomers in Singapore will likely get a private rental flat first. This allows them to explore the country’s districts and neighborhoods. Private rental apartments make up the bulk of housing;in the city-state, and its rental market relies heavily on expats.

Many apartments are pre-furnished and centrally located for quick and easy commutes. Depending on your needs, you can find old-school HDB flats alongside private rental condominiums with luxury facilities (like swimming pools and gyms).

That said, Singapore is the second most expensive place to rent property in the world (after New York, US). The average rent ranges from at least S$700 to S$3,500 a month, rising by 29.7% year-on-year (2022). As such, condo units are increasingly being shunned for cheaper HDB rentals.

While a property purchase is a big financial commitment, it could be more cost-effective if you’re staying in Singapore long-term. Homeownership can be quite affordable, particularly for those starting a family or those who are married to a Singaporean citizen who are eligible for HDB. It can also present a great investment, with many HDB flats reselling for over S$1 million (2023).

The cost of buying property in Singapore

There are numerous taxes and fees on top of a property’s listing price in Singapore. The value of these depends on your residency or citizenship status.

Property Valuation fee

To get approved for a loan, you must know the actual property value. If you buy an HDB flat, you can submit a Request for Value, which costs S$120. If you purchase a private home, you’ll have to contact one of the bank’s listed valuers for a property valuation. This will cost between S$200 to S$500.

HDB fees

If you’re applying for HDB housing, you must pay an application fee of S$40 – S$80, depending on the property value.

Option to Purchase fee

The Option To Purchase fee is not mandatory. However, it’s recommended to pay it as it allows the buyer 14 days to consider buying. During this time, the seller cannot offer the home to anyone else.

The option fee ranges from S$1-1,000 for HDB housing. For private property, it’s usually around 1% of the agreed price.

Offer to Purchase fee

Instead of an Option to Purchase, you can also pay an Offer to Purchase fee. This is more final than the option to purchase and tells the seller you will definitely buy the property.

Offer to Purchase fees are normally 5% or 10% of the agreed purchase price.

Buyer’s Stamp Duty

All real estate in Singapore is subject to buyer’s stamp duty. You’ll pay an extra:

- 1% on the first S$180,000

- 2% on the next S$180,000 (i.e., S$180,000-360,000)

- 3% on the next S$640,000 (i.e., S$360,000-1M)

- 4% on the next S$500,000 (i.e., S$1M-1.5M)

- 5% on the next S$1,500,000 (i.e., S$1.5M-3M)

- 6% on any remaining amount (i.e., S$3M+)

You must also pay a 0.4% stamp duty on securing mortgage documents. The total amount is capped at S$500.

Additional Buyer’s Stamp Duty

Foreigners must pay an Additional Buyer’s Stamp Duty (ABSD) on top of the total sale value and any auxiliary costs. This duty was increased from 30% to 60% in April 2023.

There are some exceptions to the ABSD, however:

- Permanent residents only pay an extra 5% ABSD when purchasing their eligible first home

- Citizens from Iceland, Liechtenstein, Norway, Switzerland, and the US don’t have to pay ABSD; instead, they are charged the same as locals (up to 6%)

Legal fees

If you’re not experienced in buying property, it’s recommended you get legal assistance. These can advise you on property prices, how to register, and what documents to file.

When buying an HDB home, you can appoint the HDB to act on your behalf. Their costs are far more affordable than commercial rates. If using a lawyer, you can expect to pay around S$2,500-3,000.

When it comes to paying fees, Wise has a specialist team to help move large transfers abroad and can save you money on currency exchange fees.

How to finance a property purchase?

Mortgages

Mortgages in Singapore are typically reserved for residents who are:

- 20–65 years of age

- Minimum income of S$24,000 per annum for single borrowers and S$36,000 per annum if there’s a co-borrower. Some lenders require up to twice this amount when you are an expat.

- Your Total Debt Servicing Ratio (TDSR – i.e., how much of your monthly income goes to any loan repayments, including car loans and personal loans) cannot exceed 60%

You can apply for a mortgage through a bank or a broker. Citizens and permanent residents can also get a loan from HDB, which has reduced interest rates. Well-known mortgage brokers in Singapore include:

The tenure of home loans typically ranges between 10 to 35 years. The Loan-To-Value ratio (LTV) is capped at 75% on standard bank loans and 80% on HDB loans. That means you can borrow up to 75% of the property value when lending from a bank and 80% when lending from the HDB. A mortgage calculator can help you plan monthly repayments depending on your chosen property in Singapore.

Assistance programs

Singapore’s assistance programs are available exclusively for permanent residents and citizens below a certain income threshold. Other expats can only apply for an HDB housing scheme if their co-signer is a permanent resident or citizen of Singapore.

Housing assistance includes first-time buyer subsidies, such as the CPF Housing Grant Scheme, the Enhanced CPF Housing Grant, and the Proximity Housing Grant. You’re allowed to combine these. As such, applying for first-time buyer subsidies can be particularly advantageous for new families, who can claim up to S$190,000 in HDB grants.

How to find real estate in Singapore?

Once you’ve truly decided to buy a property in Singapore, you can start searching for a suitable home. You can find new and subsidized HDB houses on the HDB website. All private properties are listed through property agencies. These generally operate across the city, although you can also find region-specific realtors.

Property agents

Most real estate agencies have an online presence with search options and free regular newsletters to update you on the available properties. All legal agencies must be registered with the Council for Estate Agents. Note that they cannot dually represent sellers and buyers at the same time and must act on behalf of only one party.

The standard commission among estate agencies in Singapore is 2%, but you may also find lower (or higher) rates.

The largest agencies in Singapore include:

These provide more than just a property portfolio; they offer market analysis, rental management, and legal assistance.

Where should you buy in Singapore?

Purchasing property in the Central Region

Home to Central Area, Kallang, Little India, Queenstown, and other popular districts, the Central Region is Singapore’s second-most populous area. While mainly consisting of high-quality flats, there are also prized colonial homes and luxury good-class bungalows in some of the city-state’s most sought-after areas.

Housing prices here typically gain the most value. It is also home to the most expensive property districts, including the prestigious bungalows of Nassim Road.

Buying real estate in the North-East Region

The North-East is the most densely populated region of Singapore. As a result, there’s a wide variety of property types available. Flats dominate the housing market, but quite a few new developments exist as well. These include so-called new towns (like Punggol) and former fishing districts converted into desirable residential neighborhoods with a mix of public and private housing.

Purchasing real estate in the West Region

The West Region is home to some of Singapore’s most affordable housing, including generally cheaper areas like Bukit Batok and Jurong West. While houses and communities are usually older, the area is being rejuvenated with new estates and properties. As a result, the West Region is considered one of the city’s most up-and-coming areas, with neighborhoods like Choa Chu Kang undergoing redevelopment.

Viewing and choosing a property

You can schedule a viewing with the agent by phone or email. During the COVID-19 pandemic, there was an increase in online property viewings, and some realtors still provide this service. However, nothing quite beats the in-person experience, as there are fewer chances of misrepresentation. If you buy something after only seeing it online, you do so at your own risk.

You can take a list of any personal must-haves with you to your property viewing and explore the surrounding area. You should also check the property’s condition, plumbing, and electrics, and ask about the reasons for selling. Singapore is constantly changing with property updates and developments, so be sure to check the area for future developments that may benefit – or devalue – the property (e.g., transport or retail developments).

Tips on buying real estate in Singapore

Expats looking to buy a home in Singapore may want to:

- Research areas thoroughly before committing to any purchase. If you don’t know the area, you might consider renting there first.

- Know the market before making the jump. For example, you can use URA tools to look at property data. You should also keep an eye out for Singapore’s up-and-coming property locations.

- Explore different banking options and mortgage rates

- Visit your desired property at different times of the day, including at rush hour

- Read up on the 10 most common home-buying mistakes and learn how to avoid them

The process of buying property in Singapore

If you require a mortgage, you should get an In-Principal Approval (IPA) from your bank. This agreement shows how much you can borrow and will give you confidence during the looking-around stage.

From conveyance to down payments, here’s the process in a nutshell:

- Making an offer – Once you’ve decided on a property, you can make an offer through your chosen agent. The offer will include your price and any other conditions (e.g., you also want to buy the furniture). The seller might meet you with a counteroffer for negotiation.

- Option or Offer to Purchase – You can secure your home by paying an Option to Purchase or Offer to Purchase fee. This fee contributes to the down payment.

- Making the down payment – You’ll have to transfer the down payment of the property within 21 days. This is typically 5% of the sales price, depending on your loan terms.

- Completing the legal process – You or your lawyers will handle paying stamp duty, signing the contract, and registering your home

- Picking up the keys – The sale is complete when you pick up your keys from your lawyer. All fees and taxes associated with the property will take effect from this day.

First-time buyers usually appoint the HDB or hire a lawyer (either privately or through their bank) to take care of the purchase process on their behalf.

Buying a newly built home

New homes are being developed throughout Singapore, including newly created condos and private properties. The process of purchasing one of these is much the same as buying any other home; only, you’ll have to wait for it to be completed.

It is worth noting that the vast majority of new builds in Singapore are done with the HDB, which has waiting lists that favor new families and first-time owners.

Building your own Singapore home

Constructing your own dream home in Singapore is difficult due to the scarcity of land and high costs. The best way to go about it is by rebuilding a landed property. Only Singaporean citizens have this option. If cost is no issue, you simply purchase a landed property and apply for planning permission to demolish and rebuild your home.

Theoretically, you can also purchase vacant land from the SLA. However, this is in short supply, and since all land belongs to the state, you’d only be leasing it.

Laws on renting out in Singapore

The housing market in Singapore is heavily regulated to prevent property bubbles and promote homeownership. There are also restrictions on owning multiple homes.

Like foreign buyers, second homes are subject to an ABSD. This additional tax adds an extra 20% to the cost owed on a second home and 30% on a third or any subsequent home(s). It’s important to realize that if you haven’t sold your old home before purchasing a new one, it will count as a second property. As such, you should sell your current property to avoid paying ABSD.

Aspirant landlords should be warned that short-term letting is illegal in Singapore. Residential property must be rented out for at least three consecutive months. If you own an HDB property, you must rent it out for at least six months.

On top of that, HDB houses are also subject to other rental regulations. For example, each neighborhood and block has a non-Malaysian non-citizen quota of 8% and 11%, respectively. According to the HDB website, this is “to help maintain a good ethnic mix in HDB estates.” If the quota has been reached, you can only rent out your property to a Singaporean tenant.

Tips for moving into your new home

Insurance

All HDB properties in Singapore require mandatory fire insurance. Privately owned flats are covered by a Management Corporation (MC). Those in landed property must take out fire insurance independently, but it’s not a requirement.

Although it’s referred to as fire insurance, this is more of a building insurance that covers against fire, lightning, pipe bursts, vehicle damage, and earthquakes, among other issues. Despite this, it can be quite limiting; it generally only covers property damage, not renovations or possessions.

While general home insurance in Singapore is not a legal requirement, it is still advised. You can find policies to protect against renovation costs, and damage or theft of your household property. Some lenders may require you to take out Mortgage Reducing Term Assurance (MRTA). This policy safeguards your property in the unfortunate event of an illness or death.

Utilities and telecommunications

Home utilities are fairly straightforward in Singapore, as there are single nationalized bodies for each one:

- Singapore Power (SP) covers electricity

- PowerGas provides gas

- Public Utilities Board (PUB) supplies water

- The National Environmental Agency (NEA) deals with garbage disposal

The SP Group manages these collectively, so you just need one account.

For your secondary needs, you can choose from a number of telecommunication, television, and internet providers. For example:

How to sell real estate in Singapore?

Selling a house in Singapore is much the same as purchasing one. While you can sell your property independently, most sales involve property agents. This is mainly a mix of convenience and tradition, as it’s the best way to get your house on the market for all to see. As with buying, make sure to hire an agency that is registered with the Council for Estate Agents. Agents typically take a 2% – 3.5% commission.

HDB properties are subject to unique rules, including a standard Minimum Occupancy Period (MOP) of five years. You must also submit a resale application and pay the fees that are attached to it.

Useful resources

- Urban Redevelopment Authority (URA) – Singapore’s land-use authority with data on private property transactions

- Housing and Development Board (HDB) – Singapore’s affordable housing system with new and resale listings, including tips on buying, selling, renting, and renting out a flat

- SRX – a popular Singapore real estate portal

- Squarefoot – a research tool for Singapore property value