As an expat moving to the Netherlands, one of the most important items you’ll need to do during your first week will be to set up an account with a Dutch bank. But first things first: how does the banking system work?

Knowing what currency the country uses, where to find branches and ATMs, and what other financial services you will be able to find at local banks is essential. It will set your mind at ease on the logistics of your new financial life.

This guide provides a complete overview of the banking system in the Netherlands, and includes the following information:

- The banking system in the Netherlands

- Currency in the Netherlands

- Banks in the Netherlands

- Banking services in the Netherlands

- Opening a bank account in the Netherlands

- Payment methods in the Netherlands

- Banking fees in the Netherlands

- Offshore banking in the Netherlands

- Ethical banking in the Netherlands

- Banking security and fraud in the Netherlands

- Making a complaint about banks in the Netherlands

- Useful resources

bunq

Ready to join banking’s digital revolution? Then join bunq today, and sign up for the fully mobile bank account for expats living in the Netherlands. Open an account in minutes, enjoy local IBANs from a number of European countries, and send money abroad with minimal transfer fees. Start your new life in the Netherlands on the right foot and bank with bunq.

The banking system in the Netherlands

The Netherlands has a robust banking system consisting of 96 national and international banks. De Nederlandsche Bank is the country’s national central bank, supporting and regulating the Dutch banking services alongside the Dutch Authority for Financial Markets (AFM).

The country’s banking assets accounted for 314% of its GDP in 2020. However, the physical banking sector in the Netherlands continues to decrease, in line with the global trend towards online banking. The country had 23 branches per 100,000 inhabitants in 2010, falling to under 12 branches by 2019. Online payments, mobile banking, and banking apps are quite prevalent in the country, with many residents and retailers preferring electronic payments over cash.

Currency in the Netherlands

The Netherlands is part of the European Union and the Euro. As such, the country uses most of the same notes and coins as the rest of Europe. This includes €5, €10, €20, €50, €100, €200, and €500 notes. Most shops and supermarkets will not accept notes above €50. In addition, the Netherlands also uses 5 cent, 10 cent, 20 cent, 50 cent and €1, €2 coins. You can find the latest exchange rates here.

As of October 2021, the current exchange rates were as follows:

- US $1.16 = €1

- GBP £0.84 = €1

- AU $1.6 = €1

- CA $1.4 = €1

Cash machines and ATMs in the Netherlands

ATMs are still quite common throughout major cities, commercial districts and smaller towns in the Netherlands. However, their numbers are decreasing due to the lower customer demand for cash. Banks are also closing ATMs due to the increase in gang activity targeting isolated Dutch ATMs. The Netherlands had half as many ATMs in operation at the end of 2020 as they did in 2016. Many of the ones that still exist are closed between 00:00 and 07:00.

If your card has the Cirrus, PLUS or Maestro symbol, along with a four-digit pin code, you will have no trouble withdrawing cash from local ATMs. However, if you use an ATM that is not within your bank’s network, you will usually incur a fee. If you need help finding an ATM, you can usually do this on the website of your local Dutch bank, or through the MasterCard Cirrus or Visa PLUS sites.

Banks in the Netherlands

It is important to research different Dutch banks to determine which one best suits your needs and principles. There are many types of banks in the Netherlands, but not all of them will suit your needs. You should also take into account that banks have varying terms and conditions on their products and services.

Retail banks

In general, you will probably use retail banks the most while living in the Netherlands. This is because these are the banks that most customers use for day-to-day banking. Normally, you can just walk into a branch and get counter service for any transactions or services you need. You can do this during regular office hours. These are usually from 09:00 to 17:00, Monday to Friday. You can also make use of their ATMs or online services.

Digital and mobile banks

It is now the era of mobile banking, and the Dutch have fully adhered to the concept. You won’t find these banks in your neighborhood but they provide the same services as traditional banks with local branches. More importantly, they offer quick customer service and high levels of security.

Private banks

Private banks offer a range of services for high-net-worth individuals. As such, these are less commonly used than retail banks. Because they offer personal investment banking, financial services, and wealth management, you will usually have a dedicated relationship manager. As such, you will be able to contact them by phone or email and set up meetings as necessary.

Investment banks

These types of banks specialize in offering financial advice and executing financial transactions on behalf of their clients. Although clients of investment banks tend to be corporations and governments, certain ultra-high net worth individuals might also use these services. Again, you will usually have a relationship manager who you can email or call.

Corporate/commercial banks

These institutions deal exclusively with corporate clients, which might include small businesses or large corporations. They offer services like loans and credit, equipment lending, commercial real estate, and trade finance. While some of these banks may have offices that you can walk into, you will more likely have to make an appointment.

Here is a list of the most popular banks in the Netherlands:

Banking services in the Netherlands

Banks in the Netherlands offer a variety of different services. Here are some of the most common services you might need while living in the country. Keep in mind that terms and conditions will depend on the bank that you choose. You can consult TheBanks.eu for product comparisons between Dutch banks, as well as banks throughout the European Union.

Current accounts

This is the most common banking service in the Netherlands because it is for personal use and is part of retail banking. As such, a current account (betaalrekening) comes with a debit card that lets you make payments in most shops and access ATMs across the country, and includes an overdraft facility. Additionally, you can usually issue standing orders or direct debits and have a linked savings account. Furthermore, these accounts allow you to access a credit card, mobile banking facilities, and international money transfers.

Overdrafts

Some banks will allow you to take out more money than you have available in your account. You can usually set a limit on your account’s overdraft. Keep in mind that overdrafts incur high-interest rates.

Loans

Loans available in the Netherlands include unsecured personal loans, secured personal loans, fixed-rate loans, and variable-rate loans. The first two either do or do not require collateral, while the latter two offer stable or flexible interest rates.

Mortgages

In the Netherlands, there is a specific type of loan that is used for buying property. There are a number of options when it comes to the type of Dutch mortgages. The two most popular are a linear mortgage (lineaire hypotheek), and an annuity or repayment mortgages (annuïteiten hypotheek).

Expat-friendly mortgage brokers in the Netherlands include Expat Mortgages and Independent Expat Finance.

Investments

Interest rates at Dutch banks are at historical lows right now. It may be a better financial decision for you to invest your surplus savings. Banks in the Netherlands facilitate a range of different investments. For example, you could invest in shares, bonds, mutual funds, and securities. A broker will help gauge your risk tolerance and decide the best way to structure your investment portfolio. You can also take a more do-it-yourself approach to investing with online brokers. These include Degiro, Trading212, or Bitvavo (specializing in cryptocurrencies).

Insurance

There are many different types of insurance in the Netherlands. However, only health, automobile, and social insurance are legally required. Home insurance is not mandatory but most mortgage providers will require it.

Renters may also find that their landlord’s home insurance does not extend to their own personal belongings. Personal liability insurance is quite common in the Netherlands to offset accidental damage. Some companies require professional liability insurance when offering consulting and advisory services. Check out our guide to running a business in the Netherlands for more information.

For help deciding which insurance policies you need and an easier sign-up process, expat-friendly insurance brokers in the Netherlands include Independer.

Opening a bank account in the Netherlands

Opening a bank account in the Netherlands is not a legal requirement, and it is possible to live in the country and manage your finances from an overseas bank account. However, this can prove difficult as well as expensive. You may also find that you need a local bank account if you wish to rent an apartment, secure a new job, or apply for a Dutch mortgage. Check out our guide for a detailed overview of how to open a bank account in the Netherlands.

Documentation generally required when opening a bank account in the Netherlands includes:

- Valid identification, plus Dutch residence permit if applicable

- Citizen service number (BSN) which you’ll receive when you register with the local municipality (gemeente)

- Proof of address (a Dutch utility bill or your rental contract in the Netherlands is usually accepted)

Payment methods in the Netherlands

The Netherlands is fully embracing technological innovations in mobile banking. Almost 90% of Dutch bank customers use mobile devices (smartphones and tablets) or internet banking (desktops and laptops) for banking services. In 2018, the usage of mobile devices for banking surpassed the use of internet banking.

Cash

The rise of mobile payment options available in the Netherlands is making cash increasingly obsolete. Nevertheless, cash still accounted for nearly one out of three transactions made in 2019, totaling €32 billion. It should also be noted that many points of sale in the Netherlands only accept debit cards and refuse to accept cash payments.

Checks

In general, checks are not used for payments at all in the Netherlands. However, banks may accept foreign checks for money transfers, as well as travelers’ checks.

Debit and credit cards

It should be noted that paying by credit card in shops, restaurants, and supermarkets is not common in the Netherlands. In some cases, it is not allowed at all. Only 0.6% of transactions were done by credit card in 2019, totaling €3.6 billion. You can apply for a Dutch credit card directly through your bank, with Visa and Mastercard being the two most common options. At points of sale where credit cards are accepted, you should not have trouble paying with your foreign Visa or Mastercard credit cards.

The preferred method of payment in the Netherlands is with a debit card (pinnen, with a pinpas orbetaalpas). This accounted for just over two-thirds of transactions and €117 billion in sales in 2019. Amounts under €25 can be paid wirelessly without a PIN code. PIN codes are generally required after every five times you use wireless payments. Following the introduction of Apple Pay in 2019, one out of four Dutch account holders is now able to pay with their smartphone or wearable devices at various points of sale.

Direct debits and standing orders

Banks in the Netherlands can issue both direct debits and standing orders on a bank account. Generally, standing orders are issued for the same amount and at regular intervals, such as rent or gym memberships. Conversely, direct debits can be authorized for varying amounts and regular payments, such as phone bills or health insurance.

The Netherlands uses the SEPA direct debit scheme. To set up a direct debit, you will need an IBAN (international banking account number) and a BIC (bank identifier code). In addition, your creditor must have a standing agreement with their bank to process SEPA direct debits. Once this is all set up, the creditor will receive your direct debit payment immediately on the set due date.

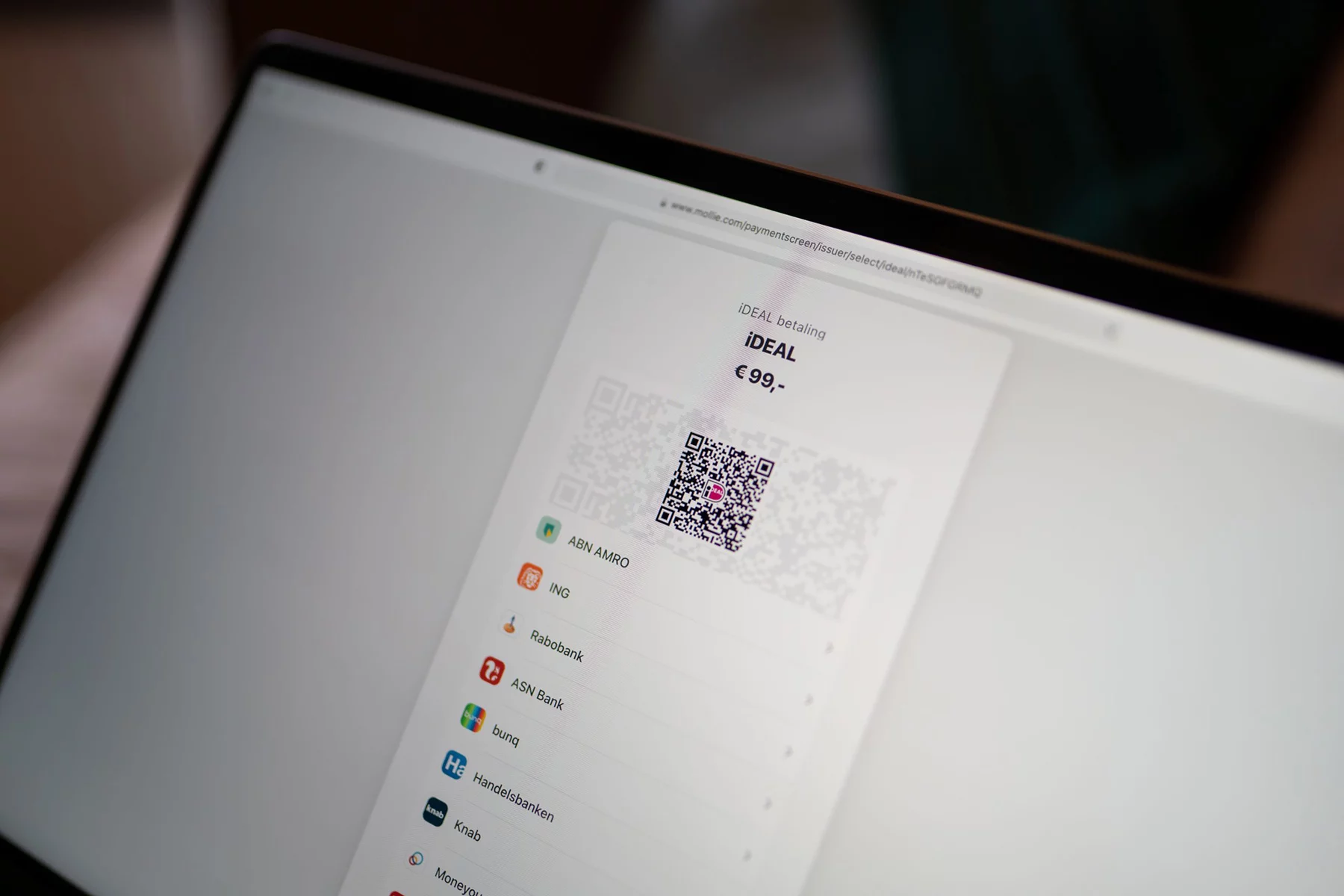

Online and mobile payments

The Netherlands is considered one of the leading e-commerce markets in the world. This is due to its high internet (95.6%), bank account (99.6%), and mobile phone (93%) penetration rates. The online payments space is dominated by bank transfers, which are used to complete 60% of all e-commerce transactions. The Dutch brand iDEAL leads this space with a nearly 60% market share.

One of the newest verbs to enter the Dutch lexicon is to “Tikkie” someone. ABN AMRO launched its Tikkie app in 2016, and it is now being used regularly by seven million account holders in the Netherlands. You can send payment requests through popular online platforms like Whatsapp and Signal. Its proliferation has led to many discussions on proper Tikkie etiquette, especially in light of reports that 10,000 requests are made each day for under €2.

Local and international money transfers

It is quite rare for anyone in the Netherlands to go into a bank to request a local money transfer. It is more common to do this online through your bank’s website or through a mobile app. However, if you need to, you certainly can do this by filling out a request form at your local bank branch.

The same goes for international money transfers. You can arrange these by using your IBAN and the BIC and SWIFT codes for your bank. You should receive your funds within 1-2 working days. For most SEPA transfers in Europe, you should not incur any additional costs. However, international transfers can prove to be quite expensive with currency exchange and transfer fees.

There are many online platforms that offer cheaper rates on international money transfers:

Banking fees in the Netherlands

Banks in the Netherlands charge fees for various services, including monthly maintenance, cash withdrawals, and obtaining additional cards. As such, you should be aware of this before deciding on which bank to go with and making any transactions. You can compare fees and services on Dutch banks through this online tool.

Many expats prefer going with the established banks where they can receive customer service in English at various branches throughout the country. However, many digital banks are revolutionizing the system by offering a slate of services with zero or minimal fees. N26 and bunq are fully digital banks that allow you to set up a free bank account. You can manage your finances entirely through your phone and even receive credit cards.

Offshore banking in the Netherlands

Some expats living in the Netherlands may find that opening an international offshore bank account is the best way to manage their finances. This is particularly helpful for anyone who works abroad, spends a lot of time in more than one country, or frequently transfers money between countries.

Dutch offshore banks entice corporations and individuals through special tax incentives and by insuring deposits up to €100,000. Some of the country’s leading offshore banks include BNG and NWB.

Ethical banking in the Netherlands

Many of the mobile banking providers are more economically sustainable than traditional financial institutions. However, there are alternative banks in the Netherlands for those who prioritize social or environmental sustainability.

- ASN Bank is the largest ethical bank in the Netherlands. It supports socially responsible businesses and promotes a sustainable society through its investments.

- Triodos Bank is also a pioneer in ethical banking. It was founded in the Netherlands but now has branches across western Europe. It finances companies focusing on solar energy and organic farming as well as in the arts and culture.

Banking security and fraud in the Netherlands

Banks in the Netherlands offer a reasonably high level of security. However, there has been a noticeable increase in phishing and bank card scams in recent years. Fraudsters have also been known to reach out to victims through Whatsapp, email, or text message. They pose as bank employees to access internet banking security codes.

Generally, Dutch banks have numerous security measures that are similar to those seen around the world. For example, they use SSL encryption for online banking, secure PINs, and one-time passwords to verify transactions. As with any bank, you should be aware of fake messages that might be phishing for your details. Additionally, you should never give out personal information unless you are 100% sure with whom you are speaking.

Lost or stolen bank cards in the Netherlands

If you happen to lose your bank or credit card in the Netherlands, you will want to block and cancel it straight away. In order to do this, you will need to call your bank or credit card issuer directly. You can find the appropriate number on your bank or issuer’s website. You should receive your new card within 4-5 working days.

Making a complaint about banks in the Netherlands

Most Dutch banks have an Ombudsman whom you can contact directly with any complaints. In addition, you can usually call, email, or fill out an online form directly with your bank to file a complaint. If you are not satisfied with the response you receive from your bank, you can also take bring your case up to the Dutch Institute for Financial Disputes (Kifid). This is primarily for issues related to insurance, mortgages, and business loans.