The Netherlands is home to some of the world’s banking giants, but most banks will accommodate expats with a new Dutch bank account. This guide will walk you through the process and give you some valuable information about banking options and what to expect when opening a bank account in the Netherlands.

The guide includes the following sections:

- Banking in the Netherlands

- Do you need a bank account in the Netherlands?

- Before opening a bank account in the Netherlands

- Types of bank account in the Netherlands

- Bank accounts in the Netherlands

- Choosing a bank account in the Netherlands

- Opening a bank account in the Netherlands as an expat

- Opening a bank account in the Netherlands from abroad

- Opening a digital or mobile bank account in the Netherlands

- Opening a bank account in the Netherlands for your business

- Opening a bank account in the Netherlands for your children

- Opening an offshore bank account in the Netherlands

- What to do if you are refused a bank account in the Netherlands

- Banking services in the Netherlands

- Managing your Dutch bank account

- Changing banks or closing a bank account in the Netherlands

- Useful resources

ING

Trust ING for your banking in the Netherlands. ING provides a wide range of services, including bank accounts, savings, loans, investments, insurance, and more. With tools to compare and calculate your options, they help you make the right financial decisions. Visit ING online and let your money go further.

Banking in the Netherlands

The Netherlands has a diverse banking system that currently consists of 96 national and international banks plus around 140 local cooperative banks. De Nederlandsche Bank is the country’s national central bank, which also regulates Dutch banking services alongside the Dutch Authority for Financial Markets (AFM).

Do you need a bank account in the Netherlands?

Opening a bank account in the Netherlands is not a legal requirement, and it’s possible to live in the country and manage your finances from an overseas bank account. However, this can prove difficult as well as expensive, so it makes sense to open a Dutch bank account. You may also find that you need a local bank account if you wish to rent an apartment in the Netherlands or get a Dutch mortgage.

Before opening a bank account in the Netherlands

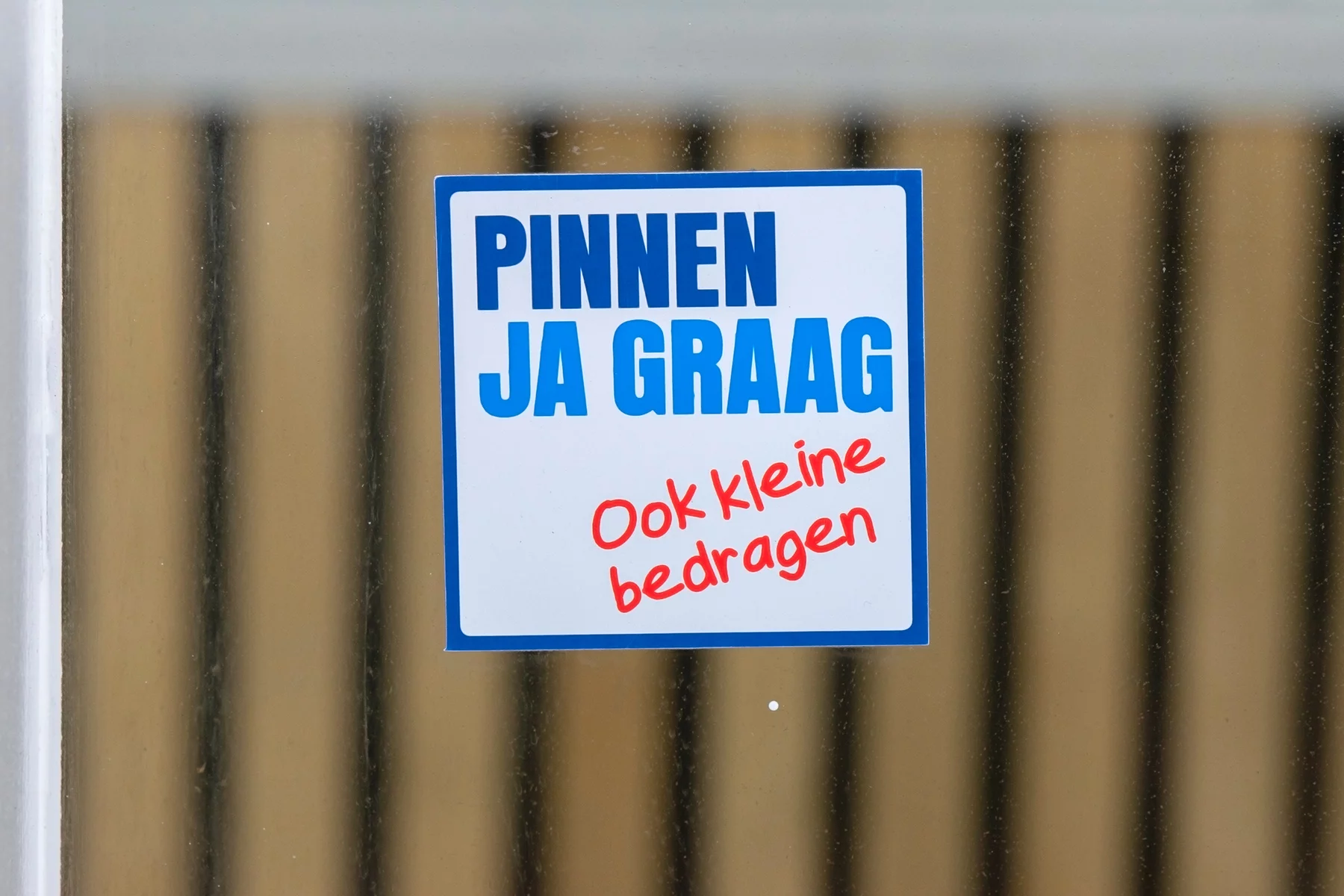

Before opening a bank account in the Netherlands, you should have no problem obtaining cash from an overseas account using an ATM or geldautomaat. They dispense money (in several languages) and accept a wide range of debit and credit cards. Many businesses, especially larger businesses, accept major credit cards. But the Netherlands has a deeply embedded debit card (pinpas) culture that means smaller, local stores may not accept credit cards – and neither will big supermarket chains.

Some Dutch banks also offer non-resident accounts that can be opened up in advance of your move to the Netherlands. Another option, if you bank with an international provider that operates in the Netherlands, is to speak to your bank about transferring your account before you move. You can then assess the various banking options in the Netherlands once you are settled and decide whether you want to stay with your current bank or open an account with a Dutch bank.

Types of bank account in the Netherlands

Most Dutch banks offer two main types of account:

- Current account or checking account: this is the standard everyday option. Most expats opening a bank account in the Netherlands will opt for a current account that gives instant access to money, debit/credit card options, mobile banking facilities in the Netherlands, and more. Banks usually offer different current accounts such as a standard account, a young person’s account, or a student account.

- Savings account: these can range from instant access savers to long-term deposit accounts which can be used to save for things such as holidays or retirement in the Netherlands. Each bank will offer different savings packages.

It’s also possible to open a joint account with many banks in the Netherlands. This can be a useful way for married or cohabiting couples to manage their finances.

Bank accounts in the Netherlands

Dutch banks that offer banking services suitable for expat residents include:

ABN AMRO

ABN AMRO offers both current and savings accounts and has an expat-friendly service that consists of English-language provision. Accounts can also be opened in advance of your move to the Netherlands. As well as mobile and digital banking options, there are also bespoke accounts available for international students, international private bankers, top sportspeople and entertainers, and a preferred banking status with luxury offerings to customers with at least €200,000 to invest.

ING

ING became the country’s largest retail bank after taking over the old Post Office bank Postbank in 1991. It offers a range of savings account options as well as current (checking) accounts for residents (at the cost of €1.55 per month), children, young people, students, and couples. There is also a mobile banking feature available in English enabling you to open an account within minutes.

Rabobank

Another big Dutch retail bank, Rabobank offers three current accounts – the Direct Pakket (standard current account for €1.55 a month), the Basis Pakket (includes credit card option for €2.90 a month) and the Totaal Pakket (deluxe account with extra features for €4.80 a month). All accounts are available online and as mobile accounts. There are tailored packages for young people, students, businesses, and joint accounts for couples.

SNS Bank

In addition to a standard current account (available for €2.75 a month), children and young person’s accounts, student account, and joint account options, SNS Bank also offers an EU Payment account. This can be opened from anywhere in the EU without the need for a Dutch citizen service number (BSN).

International banks

An alternative to opening a bank account in the Netherlands with a Dutch bank is to bank with an international bank based in the Netherlands. These include:

- Bank of America

- BNP Paribas

- Deutsche Bank

- HSBC

- NatWest

Mobile banks

Want to access all the benefits of a traditional bank from the comfort of your own phone? You can also sign up with a mobile bank, letting you access your account and other products on an app. These banks can be a good alternative and some even offer bank accounts without monthly fees. Mobile banks in the Netherlands include:

Choosing a bank account in the Netherlands

When opening a bank account in the Netherlands, it’s a good idea to shop around and weigh up the different pros and cons of all options available. Depending on your circumstances and preferences, you might prioritize different features. Things to look out for can include:

- Costs: most Dutch banks charge small monthly fees to operate their accounts. There are also other fee areas to consider such as credit cards, borrowing costs, and money transfers. You can use this EU comparison site to check costs for some of the national Dutch banks.

- Range of services: most banks offer services such as loans and insurance in the Netherlands. However, you might want to explore what’s available in terms of investments, mortgages, or special expat-tailored offers.

- Accessibility: how accessible is the bank in terms of online services, mobile services, and walk-in branch services? For maximum accessibility, a mobile account might be the most suitable option.

- English-speaking services: the Dutch are widely renowned as good English speakers. As a result, most banks will probably have some level of English language service availability. You might want to check the level of expat-friendly care if this is an important concern for you.

Opening a bank account in the Netherlands as an expat

Most banks in the Netherlands allow you to open up an account either in-person by visiting a branch or online via their website. If you want to open an account at a branch, check to see whether you need to make an appointment first. Dutch banks are typically open from around 09:00–17:00 Mondays to Fridays. Many are also open either half-day or full-day on Saturdays.

Documentation generally required when opening a bank account in the Netherlands includes:

- Valid identification, plus Dutch residence permit if applicable

- Citizen service number (BSN) which you’ll receive when you register with the tax office

- Proof of address (a Dutch utility bill or your rental contract in the Netherlands is usually accepted)

You may also be asked for evidence of income, such as employment contract or payslip when opening some accounts. If opening a joint account, then documents for both account holders will be required.

Dutch banks may check the credit rating of new customers with the Central Credit Registration Office (BKR). Once everything has been checked and the account has been opened, you should receive your bank card (usually a debit card as standard) and account information through the post within a matter of days. A four-digit PIN code for your card is usually sent out separately.

Opening a bank account in the Netherlands from abroad

You can open up a non-resident or international account with some Dutch banks. This gives you the option of opening up and operating the account from outside the country. Different banks have different offers and procedures. With some banks, accounts can be opened up only for those who plan to move to the Netherlands, while others have more general international account offers (although these may be restricted to certain regions, such as within the EU/EFTA).

Most of the main Dutch banks, however, don’t allow overseas accounts to be opened online. This means that, if you can’t visit a bank branch in the Netherlands, you’ll need to visit a branch of the bank in your home country (if there is one). Alternatively, you can go to a bank that acts as a correspondent bank with a Dutch bank. Other options are to use an international bank that has branches in the Netherlands or open up an online or mobile account that can be accessed from anywhere.

Opening a digital or mobile bank account in the Netherlands

The majority of banks in the Netherlands offer online banking and mobile banking apps. Most of the high street banking services are only available to Dutch residents. You can access online or mobile banking as a Dutch resident by simply visiting the bank’s website and signing up (for online banking) or downloading the banking app (for mobile banking).

bunq

Looking for a different kind of mobile bank? With bunq, you can open your full account in just five minutes using only your mobile phone. You get real-time access to your account, instant payments, and dedicated customer support available in English, Dutch, German, Italian, and Spanish.

Mobile-only accounts such as those available through N26 and bunq can be accessed by both residents and non-residents. Accounts can be opened in a matter of minutes using nothing more than your mobile phone. All you will need to provide is a mobile number, e-mail address, and a physical address (which doesn’t have to be a Dutch address). See this guide to mobile banking in the Netherlands for more information.

Opening a bank account in the Netherlands for your business

Most Dutch banks provide business banking as well as personal banking. They have various different business accounts ranging from startup and entrepreneur accounts through to accounts for big established businesses. If you have a business registered in the Netherlands, a Dutch business bank account is a legal requirement. Processes for opening an account depends on the type of business you are running. If you have an unincorporated business (e.g., you’re a freelance entrepreneur or sole trader), the process is similar to that for opening an individual account. If you have a limited company (BV), your business will have to be registered with the Kamer van Koophandel, which is the Dutch Chamber of Commerce. Most banks only open BV accounts with the owners/directors in person.

You will typically need to provide:

- passport/valid ID for each owner/director or account signatory;

- BSN (burgerservicenummer) for each owner/director or account signatory;

- Dutch business address;

- business registration certificate

Opening a bank account in the Netherlands for your children

Dutch banks offer certain accounts, especially for youth. Junior account offers vary from bank to bank, with many banks advertising both young children’s and teenagers’ accounts. Opening an account for your child is relatively easy in the Netherlands, with several Dutch banks allowing this to be done by parents online. ABN AMRO, for example, offer future savings and youth growth accounts.

You will typically need to provide personal details (ID and address) for both yourself and your child, as well as your BSN number. Oftentimes, parents who bank online with Dutch banks have the option of linking their child’s account with their own account.

Opening an offshore bank account in the Netherlands

Expats living in the Netherlands may find that opening an international offshore bank account is the best way to manage their finances. This is particularly helpful for anyone who works abroad, spends a lot of time in more than one country, or frequently transfers money between countries. Offshore accounts are located outside the holder’s country of residence and usually offer distinct advantages such as a wider range of cross-border services and lower taxation on funds.

What to do if you are refused a bank account in the Netherlands

Banks in the Netherlands are not obliged to offer an account to applicants and they can refuse on various grounds (e.g. if the applicant has bad credit or doesn’t meet the residency requirements). However, banks cannot discriminate on grounds of ethnicity, sexuality, or religion. If you feel that you have been unfairly treated by a Dutch bank, you can complain via the AFM which regulates banks in the Netherlands. The AFM complaints section on its website explains the complaints procedure and what options are open to you.

Banking services in the Netherlands

Banks in the Netherlands provide similar services to banks elsewhere in Europe. Beyond the standard borrowing, savings, investment, and credit card products and services, you can find:

- a range of insurance products

- mortgages

- pension plans

- international money transfer options

International money transfers in the Netherlands

For international money transfers, there are alternative solutions to banks which could prove cheaper and more convenient, such as:

Managing your Dutch bank account

You can choose how you manage your money and finances with Dutch banks, whether via counter services or remotely. The majority of Dutch banks now offer:

- Face-to-face banking – Physical banking has declined in popularity in the Netherlands as the country has embraced digital banking. There are still around 1,500 bank branches across the country where you can go and make payments, access financial advice, and more.

- Online banking – you can enjoy 24/7 access to your account through online banking. This is a key feature of most modern banks. Most services and products, including loans, are also available online and some banks now have live online chat systems to deal with issues.

- Mobile banking – mobile banking has taken off in the Netherlands, with many of its tech-savvy residents preferring to manage their finances from smartphone devices. Mobile-only banks offer all their services through an app; in fact, they don’t use physical branches at all. You can manage your funds, access services, and make a range of payments all at the touch of a screen

Changing banks or closing a bank account in the Netherlands

You can close your Dutch bank account or move to another account at any time. The exact process for closing an account will differ from bank to bank. It may be possible with some banks to close the account online, while others may require you to visit a branch and fill out a form. If you decide to close a bank account in the Netherlands, be sure to:

- get some kind of written confirmation, either in an email or a letter, that the account has been closed officially. This will prevent any additional charges from accumulating on an unsupervised account;

- cancel all direct debits or standing orders on the account, or have them transferred to your new account;

- notify your employer and anyone else making regular payments to you that you are no longer using this account.

Useful resources

- De Nederlandsche Bank: Dutch national bank

- Dutch Authority for Financial Markets (AFM): regulator of financial services in the Netherlands

- The banks.eu: comparison tool for Dutch bank accounts