Internationals living and working in Italy must contribute to the Italian social security system. This funds the country’s state pension and provides a series of benefits and allowances. Exactly how much you’ll need to contribute and the benefits you’ll be eligible for depend on your job role, income, and whether you’re employed or self-employed.

Below, you’ll find sections on the following:

- The Italian social security system

- Can you access Italian social security as an expat?

- Unemployment benefits in Italy

- Italian sickness benefits

- Disability benefits in Italy

- Italian parental benefits

- Family benefits in Italy

- Survivor benefits in Italy

- Italian health insurance

- Social security for self-employed and freelancers in Italy

- Useful resources

Moving2Italy

When relocating to Italy, get expert help from Moving2Italy on taxes, work permits, and setting up a business. They also provide personalized support for immigration, social security, and residence, helping you navigate your new life abroad. For assistance with fiscal and immigration matters, contact Moving2Italy.

The Italian social security system

The Italian Social Security Administration (Instituto Nazionale Previdenza Sociale, INPS) oversees social security in Italy. Contributions from employers, employees, and self-employed workers fund the system.

The Italian system provides a range of benefits for workers, which the government and health agencies manage. These include employment-related benefits such as sickness, disability, and unemployment payments, maternity and family allowances, and survivor pensions. However, the exact eligibility rules and contributions differ depending on whether you are a salaried worker or self-employed.

Italy has one of the highest overall social security contributions in Europe, with employers and employees collectively contributing around 40% of the worker’s salary. Italy’s rate is higher than the likes of Germany, Spain, and the United Kingdom but lower than France, the Netherlands, and Belgium.

Who has to register for social security?

If you live and work in Italy, you’ll need to register to make social security contributions. Foreign workers have the same rights and liabilities as Italian nationals.

When you start working for a company in Italy, it will be responsible for registering you with the INPS. Your social security contributions come directly out of your salary each month. Some benefits available under the Italian social security system require minimum contributions.

Self-employed workers must also register to make social security contributions, usually higher than those paid by employees.

Social security contributions

For salaried workers, contributions and split between the employer and the employee. Your overall salary before income tax determines the taxable base for your payments. Employees receive an annual statement from the INPS on 30 June each year, which specifics their contributions.

Employers generally pay around 30% of the employee’s salary into the social security system, while employees pay about 10%, according to PwC. Around 33% of the overall contribution goes towards Italy’s state pension. The remainder provides for funds covering unemployment, sickness, maternity, social mobility, and unemployment. An employee can make a maximum social security contribution of €105,014 per year.

In some instances, executives working for commercial organizations may need to make social security contributions at different rates. The exact rules can be complex, so see the guide from PwC and consider taking expert advice.

Can you access Italian social security as an expat?

Everyone living and working in Italy is entitled to social security coverage. How much you’ll receive in benefits depends on how many years you’ve contributed to the system and your financial situation.

EU/EFTA nationals

European Union (EU) and European Free Trade Association (EFTA) citizens may be able to transfer or combine benefits accrued in their home country. An EU-wide agreement means Italian residents only need to pay in one country at a time. For example, if you’ve made 10 years of contributions in your home country but now live and work in Italy, these should be counted towards your eligibility for Italian benefits.

Non-EU/EFTA nationals

Italy has agreements with all EU countries and several non-EU countries, such as the USA and Canada. You can find details of the latest treaties on the INPS website (in Italian). If you’re from a country that doesn’t have a bilateral agreement, you’ll need advice from your home government’s social security department.

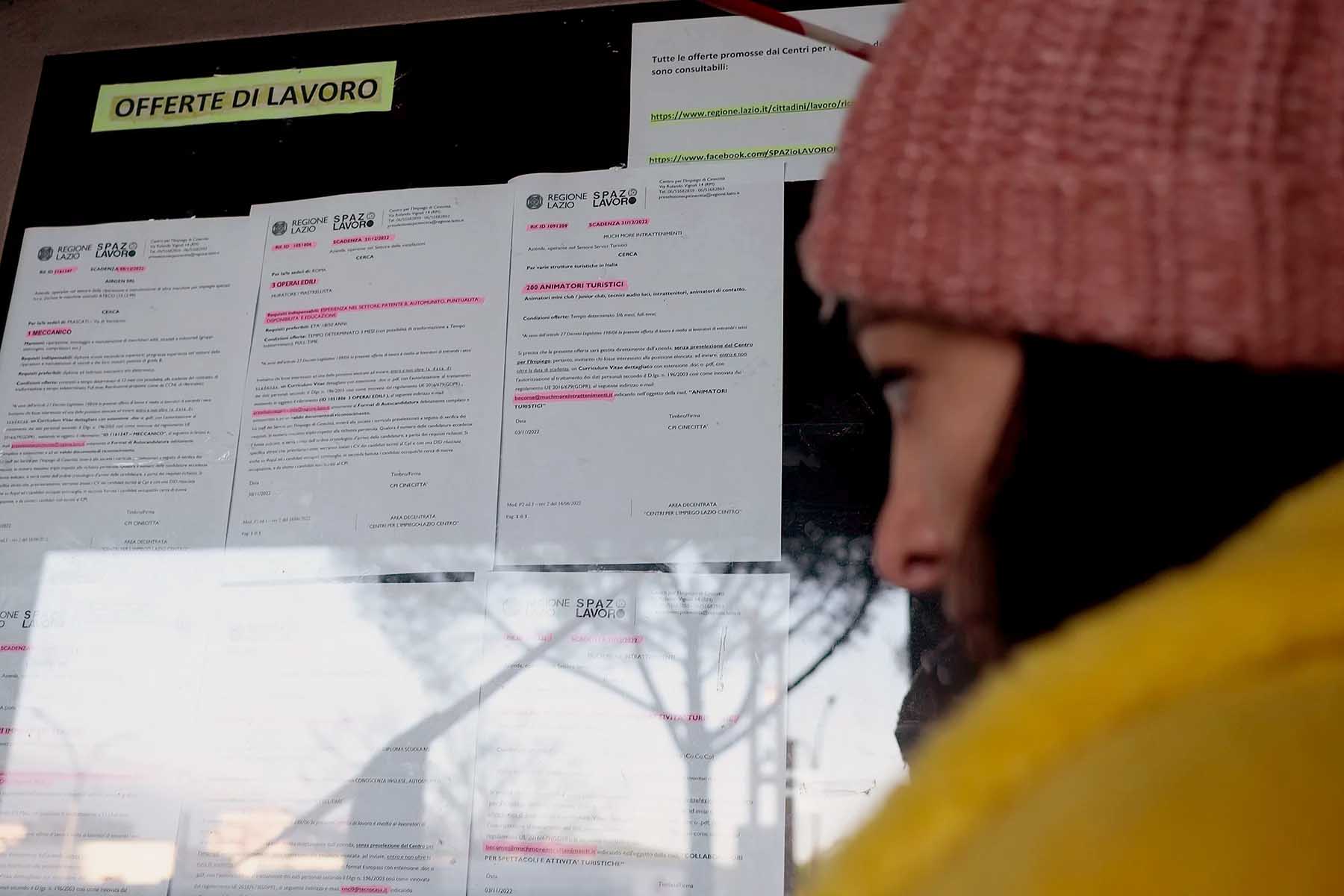

Unemployment benefits in Italy

Who can get unemployment benefits?

There are two main types of unemployment benefits in Italy: New Social Insurance for Employees (NASpI) and Unemployment benefit for fixed-term contract workers (DIS-COLL). NASpI covers involuntary redundancy and redundancy caused by the expiry of a contract. DIS-COLL covers workers with atypical employment contracts.

Payments for the two systems are calculated in the same way. The maximum amount paid is 75% of the worker’s previous salary up to €1,248 per month, and then 25% of any earnings above this sum, up to a maximum payable amount of €1,358. After six months of unemployment, the amount reduces by 3% each month.

VAT-registered self-employed workers are protected by a third regime: Indennità Straordinaria di Continuità Reddituale e Operativa (ISCRO – link in Italian). This provides a cash benefit to cover partial loss of income. ISCRO amounts to 25% of earnings from the previous year. The monthly payment ranges from a minimum of €254.75 up to a maximum of €815.20. It is payable for up to six months. ISCRO can only be requested once every three years.

Unemployment benefit contributions

To claim NASpI, you’ll need to have made social security contributions for at least 13 weeks in the four years before becoming unemployed. To be eligible for DIS-COLL, you must have been contributing for at least one month in the calendar year before your dismissal.

Unemployment benefits: how to claim

To receive unemployment benefits, you must claim online within 68 days of finishing work. You will also need to sign a declaration stating that you are available for work or enroll on a training course through a Job Center (Centro per l’impiego) or the INPS.

Italian sickness benefits

Sickness benefits: who is eligible?

If you become unwell and need to take time off work, statutory sick pay is available from the fourth day of absence and lasts for a maximum of 180 days.

From the fourth to the 20th day of illness, statutory sick pay is equivalent to 50% of your average daily wage. This increases to 66.6% between the 21st and 180th day of absence. You will receive payments direct from your employer. Contract workers are only covered for any days they are hospitalized.

Benefits are also available for accidents in the workplace (infortuni sui lavoro) and occupational diseases (malattie professionali). They can cover the cost of medical and rehabilitative care, or be paid in cash to compensate for the loss of earnings. The National Institute for Insurance Against Accidents at Work (INAIL) oversees these benefits.

How to claim sickness benefits

Your employer should contact the INPS directly to apply for statutory sick pay on your behalf. To receive payments, you’ll require a national health card (tessera sanitaria). You must also show the necessary medical certificates. If you fail to attend a scheduled medical examination, some of your pay may be withheld.

Your employer is also responsible for making claims related to workplace accidents or occupational diseases. For your part, you are required to report such occurrences to your employer as soon as possible.

Disability benefits in Italy

Who can get disability benefits?

If you’re unable to work due to a disability, you may be able to receive a disability pension (Pensione di inabilità – link in Italian) or incapacity benefit (Assegno ordinario di invalidità – AOI, link in Italian). Disability pensions are available if you are declared permanently unable to work. Meanwhile, if your working capacity has been reduced by at least a third, you can receive an incapacity benefit.

Disability benefit contributions in Italy

To qualify for benefits, you’ll need to have made at least five years’ worth of social security contributions. Two of these years can be from any period in your career, but you must have made the other three during the most recent five years of work.

Incapacity benefit is calculated based on your earnings in the year before your incapacity was declared. If you’re entitled to a disability pension, this will consist of the amount you’re due in incapacity benefit, plus the rate of pension you would have received if you continued working until the Italian retirement age.

How to claim disability benefit

You can claim disability benefit online via the INPS website. You will need to access the Public Digital Identity System (SPID) and attach a medical certificate to the claim.

Italian parental benefits

Who can get parental benefits?

Maternity leave (congedo di maternità) and paternity leave (congedo di paternità) are both available to internationals working in Italy.

Expectant mothers must take at least five months off as maternity leave. This must cover either two months before the birth and three after or one month before and four after. However, those adopting must take five months’ maternity leave starting when the child joins the family.

During this period, there is a cash maternity allowance. The rate payable is 80% of the mother’s average daily salary, based on their most recent month of work. For self-employed mothers, the calculation is based on an average of the last 12 months of income.

Working fathers are entitled to 10 days of paternity leave in the five months directly after the birth. Cash paternity allowance is paid at 100% of the worker’s usual salary.

Further optional allowances are available to parents who take additional time off from work. All parents in Italy have the right to six months of leave before their child reaches the age of three. The benefit paid during this period is 30% of usual income. These payments are only made for six months across both parents – for example, three months to the mother and three months to the father.

An additional five-month period of absence is allowed before the child reaches the age of 12. Parents can only get benefits during this period if their salary does not exceed two and a half times the Italian minimum wage.

Maternity benefits: how to claim

You can claim the above benefits via your employer or directly with the INPS. Claims for maternity leave payment can be made online prior to commencing leave and within a year of the allowance period. Further information is available on the INPS website.

Family benefits in Italy

Who can get family benefits?

Parents are entitled to child allowance (Assegno unico e universale per i figli a carico) from the seventh month of pregnancy. Child allowance is universal, with a minimum amount guaranteed to every family.

The sum payable varies from €50 to €175 per child per month, depending on the number of children and the family’s financial circumstances:

| Number of children | Minimum | Maximum |

| 1 | €50 | €175 |

| 2 | €100 | €350 |

| 3 | €165 | €610 |

| 4+ | €430 | €970 |

The amount of child benefit depends on your family’s ISEE (equivalent economic status indicator). The ISEE is used to clarify a household’s income and assets – each is placed in an overall income bracket. If you don’t submit an ISEE or the value exceeds €40,000 per year, you’ll receive €50 per child.

Family allowance is available up to the age of 21 in some cases. For anyone aged 18-21 to qualify, they’ll need to be receiving an education or professional course, earn less than €8,000, and be registered as unemployed or volunteering.

Parents are eligible for kindergarten vouchers, but the amount payable depends on their finances. Families with an ISEE of less than €25,000 can get up to €3,000 a year, while those with ratings above €40,000 are entitled to €1,500.

How to claim family benefits

You can claim family benefits through the INPS website. More information is available from the government’s Family Policy Department (website in Italian).

Survivor benefits in Italy

Survivor benefits: who is eligible?

When someone dies, survivor benefits are available to the spouse and, in some cases, the children of the deceased. The two main benefits available are survivor pensions (pensione di reversibilità), payable if they held a pension, or indirect pensions (pensione indiretta) otherwise.

The benefit starts the month following the death of the relative. The spouse has priority, followed by children and minor grandchildren.

The spouse receives 60% of the pension the deceased received (or would have received). In instances where there is no surviving spouse, children may be eligible for the benefit. If the deceased had one child, the benefit amount is 70%, for two children 80%, and for three children 100%.

If the beneficiary has another form of income worth more than three times the annual minimum wage, they may receive a lower amount.

Survivor benefit contributions

To be eligible for the indirect pension, the deceased worker must have paid for social security for 15 years during their career. Otherwise, they must have made at least five years of contributions, with at least three made in the five years immediately prior to their death.

Italian health insurance

The National Health Service (Servizio Sanitario Nazionale – SSN) provides healthcare to all citizens and legal residents of Italy. The Italian healthcare system is separate from the social security system, and national and regional taxes fund it.

Some health services in Italy are provided free of charge. This includes consultations with a doctor, emergency care, and hospital stays for serious issues. Nevertheless, some diagnostic procedures, specialist treatments, and prescriptions require a co-payment from the patient.

Some expats living in Italy take out private healthcare insurance as an alternative. Private healthcare can offer shorter waiting times, a wider selection of services, and more English-speaking doctors. Private health insurance policies include corporate health insurance, which some employee benefit packages include, and voluntary health insurance, which individuals take out on their own.

Social security for self-employed and freelancers in Italy

If you’re self-employed, you can either make social security contributions through a fund (cassa) linked to your profession or make payments direct to the INPS each quarter using form F24 from the Italian Revenue Agency. Industries with cassas include accountants, lawyers, and doctors.

Customer Success Specialist, Xolo

Maria Bozzo

Insider Tip: Pensions for freelancers

Freelancers are required to pay social security contributions to a designated pension fund, such as INPS (National Social Security Institute) or private professional funds (Casse Previdenziali). The contribution rates vary by profession and can represent a substantial part of your expenses.

Self-employed workers make higher contributions than salaried workers. If you’re an established self-employed worker, how much you’ll pay depends on what you earned in the previous year. However, if you’ve only recently registered as self-employed, your contributions will be based on an estimated minimum income. Overall, self-employed workers can expect to contribute around 24–26% of their earnings.

Useful resources

- INPS – Italian social security administration

- European Commission – explanations of social security allowances

- PwC – guide to social security contributions