The private health insurance industry is extremely competitive with numerous providers. These companies offer a complex range of private health insurance plans and supplement insurances, varying conditions for coverage, and restrictions on who and what is approved. This means that you must read the fine print to know what benefits – or pitfalls – you’re getting into.

Alongside this, private health insurance companies offer a number of ways to reduce the cost of your insurance, such as co-payment schemes, paying a higher deductible on your healthcare bills, or packaging insurance plans together.

What is private health insurance? This guide takes you through the policies and pitfalls of private health insurance and supplement insurances to help you choose the right private health insurance plan and the best private health insurance company for your situation.

- Private health insurance: basic features

- Applying for private health insurance

- Private health insurance plans: Possible policy exclusions to watch for

- Paying private health insurance claims

- Private health insurance in an emergency

- Medical evacuation

- Cost of private health insurance

- Renewing your health insurance plan

- Supplement policies to private health insurance

- Private health insurance companies: Making the decision

- Should you stick with major private health insurance companies?

Cigna Global

Want access to the best private medical services? Speak to the healthcare professionals at Cigna Global today and find a policy that’s right for you. Take advantage of their global network of doctors, specialists, therapists and more with coverage tailor-made for you and your family. If you’re starting a new life, get peace of mind with Cigna Global.

Private health insurance: basic features

Private health insurance policies generally offer one or two major levels of coverage:

- Comprehensive coverage including in-hospital care plus the services of doctors, lab tests, x-rays, and other scans in a non-hospital setting.

- Basic coverage includes all care and services relating to an in-patient hospital stay only, not outpatient services.

The common variables within these policies are various limits on reimbursement, a choice of deductibles (i.e., how much you pay towards treatment), and where the care is provided. But beyond this, there may be some traps waiting for you unless you look carefully at what is offered. It’s also important to understand how pre-existing conditions are classified, which is explained below.

Applying for private health insurance

It’s easy to get coverage from guaranteed-issue private health insurance plans; just answer a few easy questions and pay your premium. Beware, though: when you submit a claim, you may be asked for proof that the problem you just treated wasn’t a pre-existing condition at the time you applied for the policy.

Pre-existing conditions included in private health insurance

A pre-existing condition generally means a medical condition, which is currently being (or was previously) treated and any condition associated with it.

‘Treated’ is clarified in several different ways:

- Doctor visits, tests, taking medication, or even a special diet for that condition within a set amount of time.

- A condition that a prudent person would have had treated, even if you didn’t, or, in some policies, even if you didn’t know about it but they feel you should have.

- ‘Any condition associated with it’ means a medical problem that they deem to be an outgrowth or result of the original pre-existing condition.

If private health insurance companies decide it’s a pre-existing condition, they may deny the claims. Always remember, the larger the cost the more carefully they’re going to examine your private health insurance claim, which is not what you want when you have just incurred a claim for €10,000.

Fully-underwritten private health insurance plans ask very detailed health questions on the application form; they may even ask for doctors’ reports. Based on the information they gather, the insurance company can either accept you (which could be done unconditionally, with an increased premium, or with an exclusion for a specific medical condition) or reject you.

It makes sense to disclose pre-existing conditions on your application form, even if the application doesn’t ask about them. Then, the insurance company will find it harder to deny a claim for a pre-existing condition if they didn’t exclude it when they approved your private health insurance application.

Your age

Some insurers automatically reduce benefits, charge extra premiums, or even discontinue your coverage when you reach a specific age. For example, at 60, 65, or 70, the maximum annual limit under the policy may drop from €1 million to €100,000. They may also add 25% extra to the premium. If this is applicable now or within 10 years, you should calculate how age will affect your private health insurance costs or the continuation of being covered for life. Some private health insurance companies specialize in plans for elderly people.

Private health insurance plans: Possible policy exclusions to watch for

Travel

Some policies exclude travel if it’s specifically to get medical care. Others exclude care if you travel against the advice of a physician or while you are on a waiting list for treatment. In that case, treatment for that specific condition may not be covered while you’re traveling; be sure to check your policy.

Pregnancy and childbirth

Some policies exclude pregnancy and childbirth completely while others exclude them only for a set period (e.g., the first nine or 12 months of the policy).

Even if pregnancy and birth are covered, some policies exclude the first 15 days of a newborn’s life, while others cover only the first 14 days. In these cases, the baby must then apply as a separate person. Because many policies exclude birth defects and congenital or hereditary illnesses, your baby may be refused coverage. Such policies may not be appropriate if you’re in the childbearing years. Take a thorough look and ask questions before you choose one of these plans.

Chronic illnesses

Some policies specifically exclude or limit the coverage of conditions which are, or become chronic, after you purchase the policy. An asthma attack (acute) may be covered but not ongoing asthma problems (chronic). Anyone will a pre-existing condition should undertake extra research to ensure their insurance covers them.

Limited coverage

Some policies limit coverage for any single accident or illness. Limitation periods are often about the first 12 months of treatment following the onset of that accident or illness.

Organ transplants

Some policies exclude such procedures, while some offer it as an add-on or even as a part of regular coverage. If this is important to you, ask what their policy is here.

Location

Some private health insurance plans place no limitations on where you can go for healthcare while others limit the region of the world where they will cover you. Typically, insurance companies charge different premiums based on the regions you select; in particular, including the United States in your private health insurance plan will increase your premiums, due to the extreme costs of healthcare in the United States.

Home country

Some policies limit the time you can spend in your home country or even exclude it completely. For example, some plans limit travel to the United States to 30 or 60 days for citizens.

This could apply even if you go for a short visit and then, because of an illness or accident, need to stay longer. The policy may be canceled or suspended when you reach that maximum time limit, regardless of your health condition at the time.

Paying private health insurance claims

Pre-certification

Many private health insurance plans now require you to get prior approval for a planned hospitalization, with a penalty of reduced benefits if you don’t. They may be more lenient with emergencies but still require notification as soon as possible after the emergency.

Some policies also limit the choice of hospitals or doctors you can use. Even if you don’t need pre-approval, informing an insurer before a hospitalization is a good idea since they can confirm if your medical provider is approved. In this case, they usually pay the hospital directly for your stay.

Non-hospital bills

In most cases, you must pay physicians or laboratories out of pocket and then submit those bills with proof of payment to your private health insurance company.

Submitting claims

Some private health insurance companies require a completed claim form, while others will just ask for the original bill. In almost all cases, you should get the bill in English or supply an English translation (or in whatever language your insurer operates). This tends to smooth the path to reimbursement.

These points are also factors to consider when choosing your private health insurance plan, particularly whether the process for making a claim is easy, if it is done online, or if your insurance company offers support in your language.

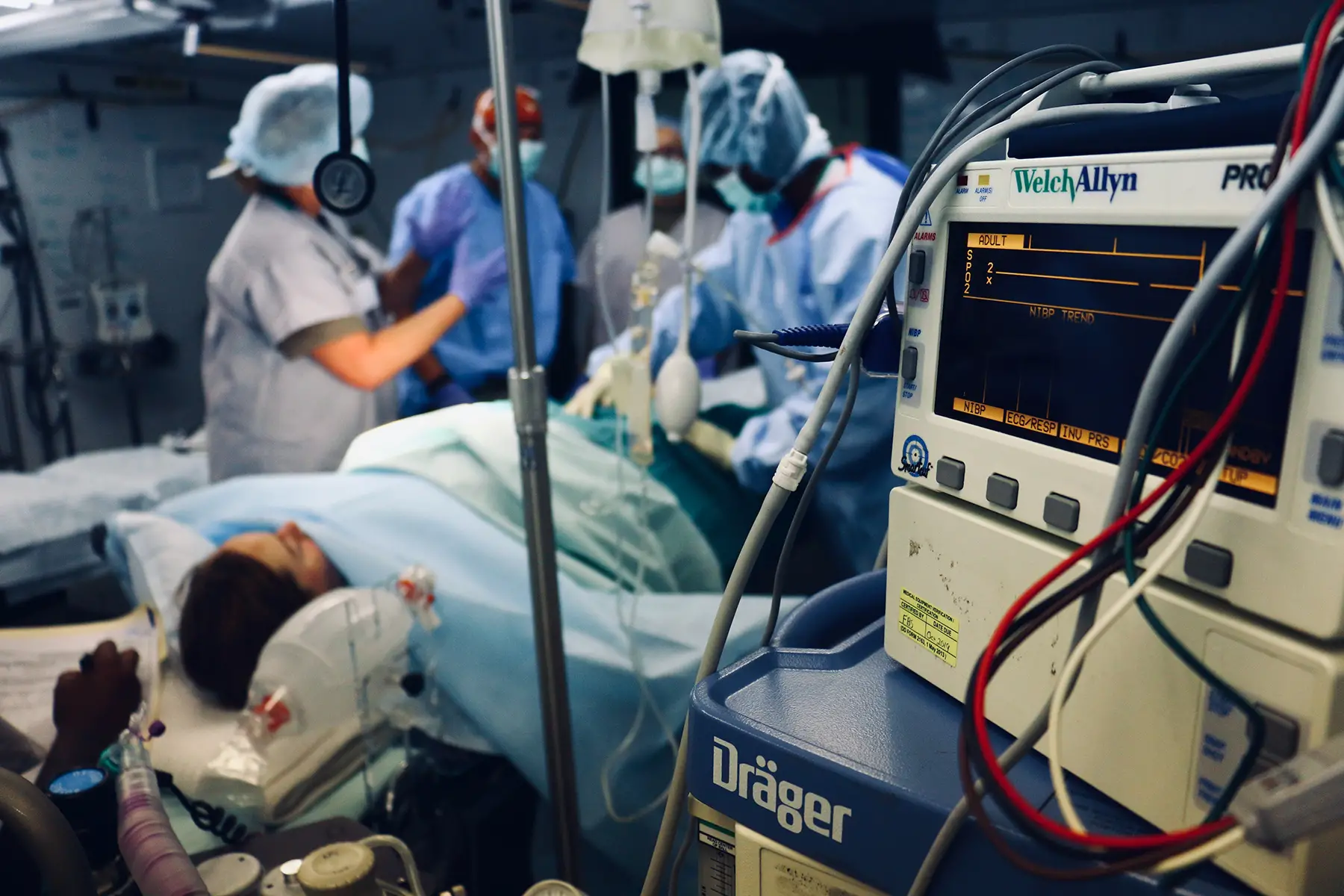

Private health insurance in an emergency

Almost all private health insurance plans offer the services of an international help center. The center can refer you to an English-speaking doctor or hospital and assist in a medical evacuation. This is more useful when you’re in a non-English-speaking area, but you can use it wherever you are in the world.

Medical evacuation

This is a typical feature or supplement of private health insurance that is often not available in state or local health insurance.

It can be particularly useful if you’re in a country with a healthcare system that is below par. If the emergency can’t be treated locally, you will be evacuated to the nearest major facility capable of providing a decent standard of care. But, be aware that no policy offers evacuation just because you would prefer it.

The emergency help center and the insurance company jointly decide on the definitions of ‘nearest’ and ‘decent’.

Cost of private health insurance

Private health insurance is normally payable for each person in a family. However, some policies do offer a family premium at a lower price. Other plans cover pre-teen dependent children for free. This could be a deciding factor for families when choosing a private health insurance plan.

The cost of your private health insurance will typically be based on where you live or where you want to have treatment. It typically increases with age and pre-existing conditions. Many providers allow customers to choose the currency for premiums and reimbursements.

Renewing your health insurance plan

Guaranteed renewability of a private health insurance policy is fundamental to the selection of that policy. If there is no guarantee to renew coverage regardless of your health condition at the renewal date, beware. Cancellation of coverage is not what you need if you have developed a medical condition that would be deemed pre-existing if you have to apply for another policy.

Supplement policies to private health insurance

When choosing your private health insurance, there will be a range of supplement insurances offered that allow you to create a private insurance package tailored to your individual situation. Below are explanations of some supplementary private health insurance.

Dental insurance

Dental insurance is typically inexpensive, although it depends on how much you are willing to co-pay. A simple dental insurance plan, for example, can be as low as €10 per month; this could include free dental cleanings, checkups, and discounted treatment costs. Dental insurance is often a supplement to a private health insurance. However, you can also take out dental insurance independent of any other coverage.

Vision insurance

In some cases, vision insurance describes what is essentially a discount payment plan for eye care and eye wear. Vision insurance can significantly reduce the cost of your eye exams, prescription glasses, and contact lenses. It doesn’t necessarily cover medically necessary eye surgery such as cataract surgery, however. Vision insurance plans generally don’t cover elective surgery such as laser eye corrective surgery; these plans sometimes offer elective surgeries at a discount.

Accident insurance

Accident insurance covers medical out-of-pocket expenses that result from accidental injuries, including emergency services, hospital stays, medical exams, transportation, and lodging. It fills in the gaps of certain costs not covered by private health insurance.

Critical illness insurance

Critical illness insurance typically pays out a lump-sum benefit in the event of a diagnosis of certain illnesses (e.g., heart attack, stroke, cancer). Insurance companies provide lump-sum payments for medical expenses, lost work time, childcare fees, and travel expenses.

Life insurance

Life insurance provides your partner or family financial security in the event of premature death. This insurance can be useful when you have dependent family or large debts; indeed, life insurance is an important component of financial planning for expats. Some life insurance policies have investment features that can provide advantageous tax benefits, although more complex life insurance policies tend to be expensive. Surprisingly cheap basic life insurance plans are available: for example, a healthy, 30-something, non-smoking male might find a 20-year term policy with a €1 million death benefit for less than €500 per year. Premiums rise 10–20% for added features or more complex plans, such as variable or whole life insurance policies.

Short-term health insurance

Some circumstances call for short-term health insurance, which is essentially temporary private health insurance. Short-term health insurance plans can be anywhere from 30 days to 12 months, depending on the insurer. These provide a useful way to cover health insurance gaps or if you have to quickly show proof of insurance.

Compared to other plans, short-term health insurance can have lower premiums and approval is typically easier and quicker, but they also might offer limited benefits, exclude pre-existing conditions, don’t qualify for tax exemptions or are not guaranteed-issued.

Travel insurance

Travel insurance falls into two broad categories: trip cancellations and travel medical insurance. An insurance policy for your trip typically covers costs associated with canceled or changed flights. There are many variations that include coverage for delayed or lost baggage, travel delay, rental cars, flight accidents, and identification theft. It does not necessarily cover medical expenses.

Medical insurance for travel covers you in the event of an emergency accident or illness abroad; this can include emergency medical evacuation, accidental death, and repatriation. Travel insurance often includes a combination of both medical and trip coverage, covering both you and your possessions. However, check your travel insurance policy to be sure.

Medical facilities abroad often do not recognize foreign health insurance; travel insurance plan covers you in such cases. If you have international health insurance, you’ll typically receive coverage for medical treatment abroad, and some private health insurance plans cover emergency treatment abroad up to certain period (for example, one or three months). However, these plans do not insure your belongings; in this case, travel insurance is a better option.

Private health insurance companies: Making the decision

Finding providers is the easy part. But with all the different options offered by insurance companies, how do you make the final choice?

“Many of our clients are aware from their own research that there are more insurers than ever. They come to us for guidance,” says Andrew Wilson, CEO of April Medibroker, a specialist broker advising expatriates on health insurance.

“Expats should seek the advice of an independent broker who is not tied to a provider and has access to a large number of insurers before signing up,” Andrew says.

There are many things to consider when choosing from the many providers. Perhaps the most revolutionary aspect of medicare insurance in the last 10 years is pre-existing medical conditions. In the past, insurers excluded pre-existing medical conditions from coverage.

Choosing the right area of cover is another important task. Generally with expat health insurance, there are three regions of coverage: Europe, worldwide excluding the United States and Canada, and worldwide. It’s not just the country they are going to be living in that expatriates need to think about.

What if they were to develop a condition such as cancer? Would they want to stay in unfamiliar territory, or would they want to return home? Also, what if the medical facilities in their new country are sub-par? In this case, evacuation coverage is essential.

Many expats consider local plans in today’s economic climate. However, a local plan means exactly that: local care in a local language. Expats must think about where they want treatment for serious conditions; in this case, private health insurance or international health insurance becomes relevant.

Should you stick with major private health insurance companies?

Not always, according to insurance broker Andrew Wilson, who observes that smaller private health insurance companies can sometimes be much better in their administration and customer service. They also have the ability to treat each customer as an individual rather than a number. As they are smaller, they can be quicker to proactively respond to the changing needs within the marketplace.

That said, larger private health insurance companies can be more widely recognized by medical institutions in some remote places. They may offer wider medical networks or complex online systems for making claims, finding specialists, and booking appointments. Other companies will allow claims by e-mail, when others need claim forms.

“There really is a lot to consider,” Wilson says. “In the more than 15 years’ experience we have gained, things are changing more than ever, and more quickly than ever before in the insurance market. That’s when the expert advice and guidance of an experienced broker can help.”