If you want to live or work in Belgium, you will probably need one of the two Belgian identification numbers. A tax identification number in Belgium covers taxes, but it’s also necessary for other tasks, like receiving social security benefits, applying for a driving license, or starting a business.

We cover everything you need to know about identification numbers in Belgium, including:

- Types of ID numbers in Belgium

- What information does the Belgian government keep about me?

- Where do you find your Belgian national number or BIS number?

- Using your Belgian national number

- Who needs a Belgian national number or BIS number?

- How to apply for a national number in Belgium

- Does my Belgian business need an ID number?

- Useful resources

KBC

Looking for a bank that meets all your financial needs? KBC is a retail, online, and mobile bank operating in Belgium. Take advantage of their easy-to-use mobile banking current accounts or head in-store to discuss your home loan or insurance options with their experts. Take the stress our of your move to Belgium by opening a KBC account today.

Types of ID numbers in Belgium

Everyone living, working, or operating a business in Belgium must register for an identification number. Unlike in many other countries, this tax number is for more than just taxes – it covers you for many government services, including social security.

The type of number issued depends on your residence status:

- A National Register Number (Dutch: rijksregisternummer, French: numéro de registre national), also known as the national number, is issued to all residents of Belgium and appears on passports or ID cards for Belgian citizens. Residents have it on their residence cards or documents.

- A non-national BIS number (Dutch: ibis-nummer, French: numéro Bis) is issued to individuals who are not required to register in Belgium’s National Register, such as foreign nationals who work or live in the country for less than three months.

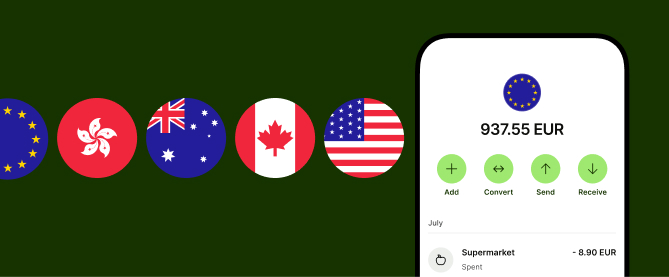

For expats moving to or living in Belgium, managing finances across borders can often be a challenge.

Wise multi-currency account supporting 40+ currencies can be particularly helpful during your transition period, allowing you to hold and manage both euros and many other currencies while you establish your life in Belgium.

What is the national number?

The Belgian national number is a multi-purpose identification number for tax identification, the national register, and social security. The Belgian government issues it through the Federal Public Service department.

Businesses registered in Belgium also need a national number for identification when filing corporate tax.

BIS Number in Belgium

Belgian BIS Numbers record temporary entrance to Belgium for foreign nationals but do not provide access to social security or require tax reporting. BIS Numbers are only necessary for foreign nationals spending 90 days or less in the country, such as those taking on short-term work assignments in Belgium.

Wise

Managing finances across borders becomes simpler with Wise. Hold 40+ currencies including euros in one account, transfer money at the mid-market exchange rate, and get account details in 20+ currencies for receiving international payments easily.

What information does the Belgian government keep about me?

Any person or business issued a Belgian national number or BIS number will have the following information recorded by the Belgian government:

- Address of record (either residential or primary place of business)

- Civil status, such as records of birth, marriage or changes to citizenship status

- Nationality

This information is recorded in the National Register of Belgium. The data may only be shared with other public services and institutions.

Where do you find your Belgian national number or BIS number?

Belgian citizens find their national number on their passport or Belgian ID card. Residents can find it on their residence cards or visa documents. The national number consists of 11 digits, with the first six corresponding to the individual’s date of birth.

Electronic ID cards (eID) are also available in Belgium. There are three types:

- Belgian ID for nationals over 12

- Kids-ID for citizenss under 12

- Foreigners ID for foreign nationals living or working in Belgium

Foreign nationals who do not require a national number but have a relationship with the Belgian government, such as those working 90 days or less in the country, receive a BIS Number. You can find this on tax documents.

As with the Belgian national number, a BIS Number consists of 11 digits. The first six digits still correspond to the individual’s date of birth, but the birth month number is increased by 20 or 40.

Using your Belgian national number

You need a Belgian National Number to complete many routine activities in Belgium. You will need to provide your National Number when:

- Paying taxes in Belgium

- Opening a bank account

- Finding a job

- Accessing Belgian social security benefits

- Buying a property

- Setting up utilities

- Starting a business in Belgium

- Registering for self-employed or freelance business

- Obtaining credit in Belgium

- Registering and insuring a car

- Applying for a driving license

- Access online government services

If you are working in Belgium for less than 90 days, your employer should apply for a BIS number for you. Tourists, on the other hand, only need a national number if they plan to set up residence or start a business in the country.

Who needs a Belgian national number or BIS number?

Everyone living and working in Belgium for more than 90 days requires a national number. Belgian citizens receive theirs automatically, but foreign nationals must register for one. This includes international students and employees moving to Belgium on a work visa.

Those working in Belgium for less than 90 days need a BIS number. If you take on a short-term, temporary assignment, your employer might need to apply for one on your behalf.

How to apply for a national number in Belgium

If you’re staying in Belgium for longer than three months, you must register your address at the municipality. At this point, you’ll receive your national number. Additionally, this number comes automatically as part of other documents, such as work and residence permits and marriage certificates. You do not have to apply separately in most cases.

If you haven’t received a residence permit or ID card containing a Belgian national number or have lost your documentation, the best place to contact is your local municipality (Dutch: gemeente, French: commune). You will likely find your municipal office at the local town hall.

There is no fee for a Belgian national number, as it forms part of various other documents.

While waiting for your Belgian national number to be processed, you may need to manage expenses or receive funds from abroad. Wise can help you send and receive money internationally at the mid-market exchange rate with low fees, helping you move your finances to Belgium smoother.

Does my Belgian business need an ID number?

If you set up a business in Belgium, it will also require a tax ID number (Dutch: ondernemingsnummer, French: numéro d’entreprise). When you register your business, you will automatically receive one – you will find it on the company documents issued during registration with the Belgian authorities.

Business national numbers are 10 digits long instead of 11 and begin with 01. If liable, you’ll also receive a VAT number (Dutch: btw-nummer, French: numéro de TVA), which is the same as your business ID, but begins with BE.

You must mention your ID number on all commercial documents, such as letters and invoices. If your business has a website, you must publish your business ID number there. In addition, invoices should include your VAT number.

Useful resources

- Belgian Federal Public Service – organization responsible for managing the National Register and issuing Belgian ID cards and residence permits through the Directorate-General Institutions and Population

- Belgian social security website (in French, Dutch, and German) – information on accessing benefits

- The Belgian Directorate-General for Foreigners – details on immigration

- Belgian tax administration – explanation of the Belgian tax authorities

- eID – Information on electronic ID cards

- CHECKDOC – website for verifying Belgian identity documents

- Belgian communes – information on municipalities in Belgium