Whether you’re an entrepreneur, freelancer, or running your own business in Germany, you’ll need to know the various laws and rules regarding tax for self-employed workers. You’ll also need efficient ways to manage your finances, especially for international transactions.

Wise multi-currency account allows many freelancers and small businesses to simplify international payments while keeping costs low.

To help you take finances into your own hands, read on to learn about the following topics:

- The self-employed tax system in Germany

- Self-employed income tax in Germany

- Registering for self-employed tax in Germany

- Self-employed tax deductions and credits

- Corporate tax in Germany

- How to file self-employed tax in Germany

- VAT in Germany for self-employed people

- Social security for freelancers in Germany

- Combining freelance work and paid employment

- Self-employed tax fines in Germany

- Associations for German entrepreneurs

- How to find a financial advisor in Germany

- Useful resources

Wundertax

Rethink the way you do your tax returns with Wundertax. Their easy-to-use website guides expats through every step of the German tax return process, giving you more time to explore your new home. For simple and intuitive help in English, use Wundertax for your tax returns.

The self-employed tax system in Germany

To register for the German tax system, self-employed workers need a tax number from their local tax office. Once you’re registered, you’ll need to complete an annual tax return. Tax liabilities in Germany vary slightly depending on whether you run a business, are self-employed, or are a freelancer.

The types of taxes you pay also depend on what kind of business or service you’re offering. For instance, businesses providing goods must pay trade tax (Gewerbesteuer – GewSt), while those offering professional services are exempt.

While many self-employed workers are exempt from making social security contributions, it is the law to have health insurance in Germany. Some self-employed people must pay contributions to Germany’s state pension fund, while others choose to do so even if they don’t have to. Another option is to take out a private pension with a service such as Pensionfriend.

Self-employed income tax in Germany

In Germany, both expats and locals have to pay income tax. You pay income tax on your domestic and worldwide income and assets.

If you’re not-resident taxpayer, you’ll only need to pay income tax on the money you earn in Germany, and not on your worldwide income.

Taxable income includes earnings from any of the following categories:

- Self-employed income

- Capital investment

- Business income

- Immovable property and certain tangible movable property

- Royalties

- Gains from private transactions, alimony, or annuities

The German government reviews income tax brackets every year. In 2025, the following rates apply:

| 2025 tax bracket Annual income | Tax rate |

| Up to €12,096 | 0% |

| €12,097–68,429 | 14–42% |

| €68,430–277,825 | 42% |

| €277,826 and above | 45% |

Tax for sole traders and freelancers

Freelancers in Germany must apply to pay their income tax in quarterly installments when they start their business.

Tax installments are paid in advance during the year before submitting your tax return. The amount you’ve already paid is credited against the amount of income tax you owe, which is calculated after you submit your annual return.

As a result, many workers in Germany receive tax refunds. However, you may have to pay extra if it turns out that you owe more tax than you’ve already paid.

Most freelancers don’t have to pay trade tax or contribute to the German social security system. However, they should consider making their own arrangements, particularly for things such as:

- Health insurance: covers the risk of illness and the loss of income should you become sick

- Disability insurance: covers the risk of monetary loss if you cannot continue working due to illness

- Life insurance: an option to supplement retirement income

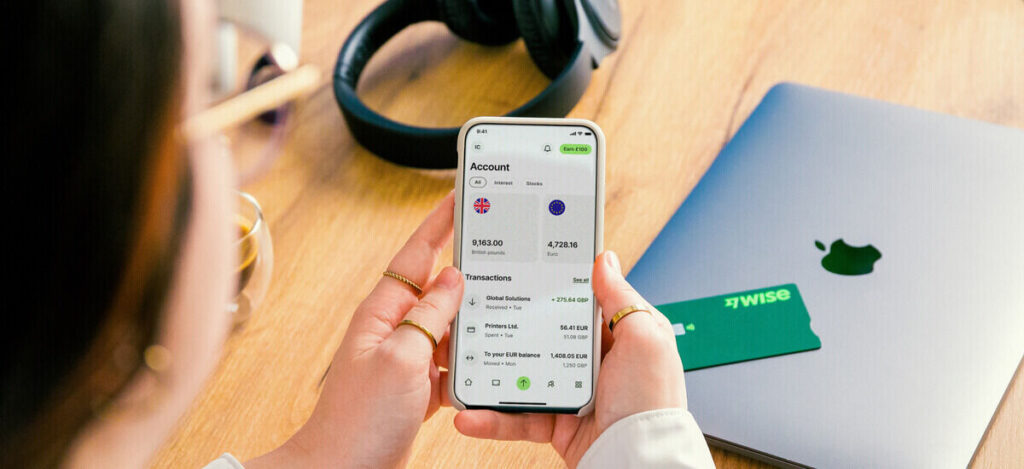

Wise Business for international freelancers

For freelancers in Germany working with international clients, managing multiple currencies can be both challenging and costly. Wise offers a business account that lets you receive payments in multiple currencies at the mid-market exchange rate. With local account details for 8+ currencies like EUR, GBP and USD, you can invoice clients and receive payments conveniently. The Wise card makes tracking business expenses simpler for tax season, and you can categorize transactions directly in the app.

Tax for partnerships in Germany

In cases where two or more freelancers work together, they can form a partnership company. Workers in liberal professions, such as doctors, writers, accountants, or tax consultants can form partnership companies.

Partnerships are not liable to pay trade tax regardless of their turnover, but income tax is deducted from the profits of each shareholder.

If the partnership employs any staff, it must also pay payroll tax.

Tax on limited partnerships in Germany

Limited partnerships in Germany are when two or more entrepreneurs or companies team up to run a company together.

Generally, there is always at least one fully liable partner and at least one limited partner. The limited partner provides investment but doesn’t take part in managing the company.

Income tax is calculated on the profits earned by the shareholders and must be paid directly by them. The general partner can offset any losses against other sources of income on their tax return.

Limited partnerships may also have to pay trade tax if the company provides goods unless they qualify as a small business.

Trade tax has a 3.5% base rate throughout Germany. Each municipality then adds its own multiplier, so that it generally ranges between 8.75% and 20.3%.

Limited partnerships also have an annual tax-free trade allowance of €24,500.

Registering for self-employed tax in Germany

When setting up a business in Germany, you must register at the local tax office, the responsible professional association, and the associated accident insurance company.

It’s relatively easy to register with the local tax authority. You can usually send an informal letter detailing information such as your name, the name and nature of your business, and your contact details. Alternatively, you can register in person at the local citizens’ service center (Bürgeramt).

The tax authorities will provide a questionnaire asking for details such as your estimated income in the current tax year and whether you want to opt-in for VAT.

The tax authorities then base your estimated income tax installment amounts on the income estimate you provide.

You’ll pay the estimated tax during the year before your tax return is due. If you earn more or less than the estimated income, you’ll either pay a tax top-up or get a refund.

While handling your tax registration, it’s also a good time to set up proper banking for your freelance business. Having a dedicated business account helps maintain clear financial records for tax purposes.

For freelancers working with international clients, Wise offers business accounts that accept payments in multiple currencies and convert them at the mid-market exchange rate, potentially saving on financial fees.

Self-employed tax deductions and credits

Tax deductions for freelancers

Business-related costs incurred during the calendar year you’re being taxed on can be deducted from your profits, reducing your overall tax bill.

Some of the most common deductible items used by self-employed and freelance workers include:

- Tools

- Website costs

- Travel expenses

- Tax software

- German telephone and internet costs

- Training

Purchases must only be for business use. In the case of telephone or internet costs – for example, where you only use your internet for work for a certain amount of time – you should calculate the proportion of your bill that’s from professional use and expense it accordingly.

Depreciation

The depreciation of certain assets can reduce how much tax you’re charged – but it’s not always tax-deductible.

There are three types of depreciation: conventional depreciation, a collective item, or the depreciation of low-value assets (purchases at a value of up to €800).

Low-value assets can be deducted in a one-time and immediate deduction, whereas higher-value purchases are usually deducted over several years.

The Federal Ministry of Finance (Bundesministerium der Finanzen or BMF) regularly publishes depreciation allowances that can help to determine how long the customary deduction period is for various assets. Laptops, for example, can be fully depreciated after three years of use.

Deductions when you work from home

If you have a home office, you can claim tax deductions based on how much of your home is used for work, and how often.

If the room where you work is used for both professional and private purposes and there is another room available, then you can’t make any tax deductions.

However, if you only carry out business activities from your home and don’t have another room available, you can deduct up to €6 for each day you work from home, capped at €1,260 per calendar year.

You can also claim deductions for things such as:

- Building deductions or rent

- Repair costs

- German home insurance contributions

- Renovation and maintenance

- Property tax

Corporate tax in Germany

Self-employed workers don’t usually have to pay corporate tax in Germany.

Corporate tax applies to corporations, cooperatives, mutual insurance companies, legal entities such as societies and trusts, and commercial enterprises run by public legal entities.

The tax is levied on a taxpayer’s business income, with a municipal business tax charged as a lump sum, which may be credited against income tax.

Germany’s federal corporate tax rate is 15% (plus a solidarity charge of 5.5%). Local municipalities then set additional rates for trade tax, which range from 8.75% to 20.3%.

In 2024, the average total combined corporate tax rate was 29.9%, much higher than most other EU member states.

How to file self-employed tax in Germany

The German tax year is from 1 January to 31 December. The deadline to file a tax return is 31 July. So, for example, your 2024 return is due by 31 July 2025.

Returns prepared by tax professionals are due on 28 February of the second year following the tax year.

You’ll receive a tax assessment from the tax office two to six months after submitting your return, detailing whether you should expect a refund or owe extra tax.

You can complete your tax declaration on paper, or online using the official software from the Bundeszentralamt für Steuern (the Federal Central Tax Office). You’ll need to fill out a general tax form (Mantelbogen). Depending on your circumstances, there may be several other forms you need to fill out, too.

To make things easier, there are a growing number of online platforms in Germany that can help you file your tax returns. These include:

These services can help make the tax return process much easier, as well as help you get any returns you might be owed. Alternatively, you can go to Mein ELSTER (in German) to file your submission. Some online explanatory forms (in German) can give some extra help.

VAT in Germany for self-employed people

In Germany, revenue generated by freelance work is generally taxable for VAT, unless it’s for services such as medical or dental services. VAT in Germany is called Umsatzsteuer (USt), though many people use the term Mehrwertsteuer (MwSt).

You either pay the standard 19% or a reduced 7% VAT rate, depending on the kind of service you’re providing. You must display the USt on invoices.

Freelancers and entrepreneurs must prepare their VAT return on a monthly or quarterly basis, depending on the VAT you paid in the previous year. You must file a preliminary VAT return every month:

- During the first two operational years of your new business

- When your VAT bill of the previous year amounted to less than €1,000, you have the option of getting an exemption. However, you’ll need to declare all revenue in your annual return (Umsatzsteuererklärung).

- When the VAT paid in the previous year was more than €7,500

If your previous VAT bill was between €1,000 and €7,500, you may submit your return on a quarterly basis.

It’s worth noting that you can deduct the amount you were invoiced from the VAT you were charged. The difference has to be paid to the tax authorities as an installment payment.

For freelancers working with clients abroad, VAT rules can be particularly complex. If you’re invoicing clients outside of Germany, you may need to deal with different VAT requirements or even reverse charge mechanisms.

Wise Business accounts can help simplify this process by generating professional invoices in multiple currencies, making it easier to keep track of international transactions for VAT reporting. Wise also maintains clear records of all transfers, which is valuable when preparing VAT returns.

Social security for freelancers in Germany

In Germany, many workers must make contributions towards social security. Generally, freelancers do not need to contribute to governmental healthcare, unemployment, and pension insurance. However, it’s a good idea to make your own arrangements instead.

Artists and journalists may need to join the government’s Kuenstlersozialkasse scheme to make insurance contributions.

The contributions depend on your income. There is a ceiling on the total annual income that contributors can make, which changes each year.

In 2025, the total contribution rates for Kuenstlersozialkasse are:

- Pension insurance: 18.6%

- Health insurance: 14.6%

- Long-term care insurance: 3.6%, though this could be lower if you have more than one child

Combining freelance work and paid employment

German tax rules enable employed workers to carry out extra freelance work. There is an added tax burden, however, and you must make sure you’re honest about any extra income you’re receiving.

Complicating your tax affairs in this way might mean it’s a good idea to get some professional tax advice.

As an expat, you must make sure your German residence permit allows you to carry out freelance work, as some are restricted to just employment. Additionally, you must also register for self-employment and may need to submit a tax return.

While your employment income is subject to a wage tax held by your employer, income from your freelance work is taxed separately. It is your responsibility to pay this tax.

The German tax office estimates your tax for the current year, and you’ll have to make income tax prepayments four times a year. Then, when it’s time to file your tax return, you’ll have to detail the income from your employment as well as your freelance income.

Wage tax that’s been withheld and provisional tax payments are deducted from your total tax liability. This means you’ll either get a tax refund or a bill asking for an extra payment.

Self-employed tax fines in Germany

Workers who fail to file their German income tax return on time may need to pay late filing fees.

For each month your return is late, you’ll be fined 0.25% of the total assessed tax. So, if your tax total is €10,000, you’ll pay €25 a month in late fees.

If you’re late paying the tax you owe, you’ll be fined 1% of the unpaid amount each month that you fail to pay it.

Failing to update the tax authorities about relevant developments to your financial situation can also be considered tax avoidance. The same applies to providing incorrect information, so make sure to double-check your details before submitting.

Associations for German entrepreneurs

There are plenty of associations for entrepreneurs in Germany, which can be a great way of gaining help and advice.

A few such associations include the following:

- Bundesverband mittelständische Wirtschaft (BVMW) – the German Association for Small and Medium-sized Businesses is a politically independent association

- Entrepreneurs’ Organization Berlin – a global peer-to-peer network of more than 14,000 influential business owners with over 200 business members in Berlin

- Wegate – campaigning for female entrepreneurship

How to find a financial advisor in Germany

If your circumstances are more complicated, or you’re not sure where you stand in the German tax system, it can be worth getting professional advice.

Consider joining a Lohnsteuerhilfeverein – a non-profit organization that can help with your taxes for a small membership fee. You can find your local center online.

A tax consultant can also advise on issues around tax law and business management, but it can be expensive. To find a professional near you, check the Bundessteuerberaterkammer (the Federal Chamber of Tax Consultants) and the Deutscher Steuerberaterverband (the German Association of Tax Advisors).

You can also browse our Business Directory to find international-friendly tax advisors to help you with your German tax concerns.

Useful resources

- Bundeszentralamt für Steuern – the Federal Central Tax Office is the main information point for all information on tax in Germany (in German)

- Deutscher Steuerberaterverband – Germany’s association of tax advisors

- Find your local tax office (in German)